BlackRock’s New Bets Stick Firm in Middle of AI, Energy Fray

PositiveFinancial Markets

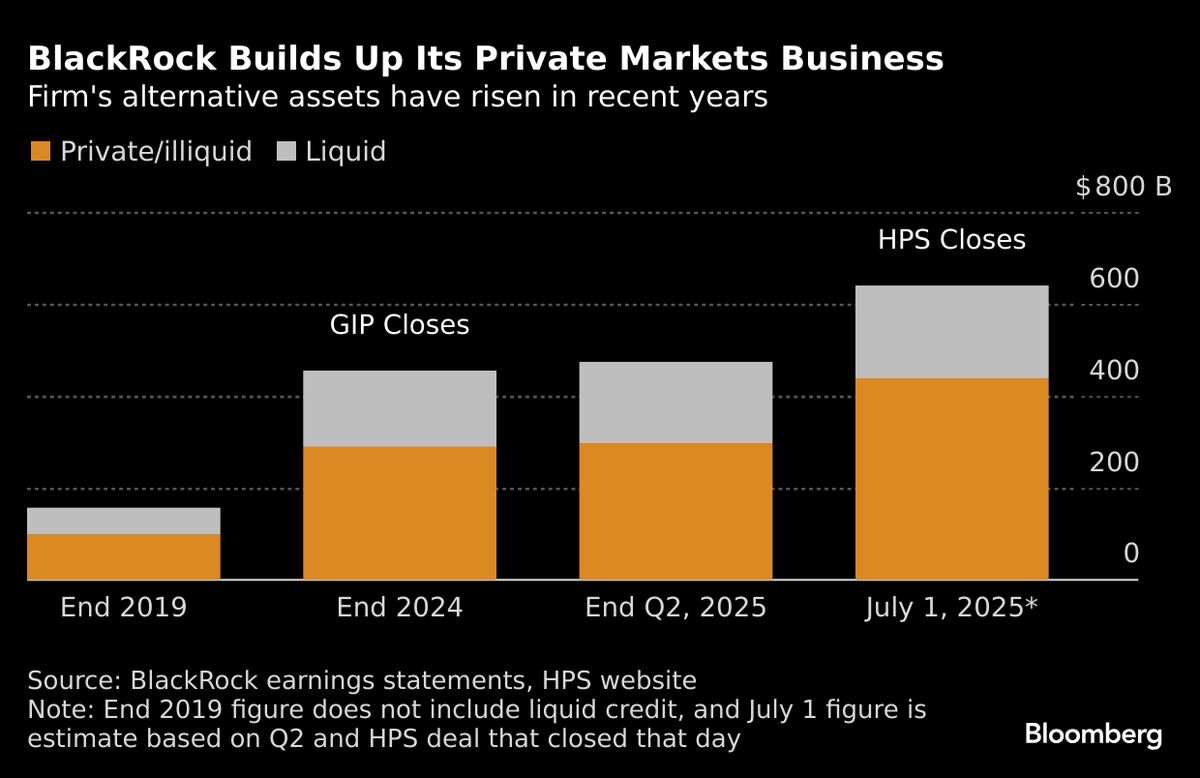

BlackRock Inc., the world's largest money manager, is making significant moves to enhance its presence in the booming artificial intelligence sector and the energy markets that support it. With over $12.5 trillion in client assets, this expansion not only reflects BlackRock's confidence in these industries but also highlights the growing importance of AI and energy in the global economy. As these sectors evolve, BlackRock's strategic investments could position it at the forefront of innovation and profitability.

— Curated by the World Pulse Now AI Editorial System