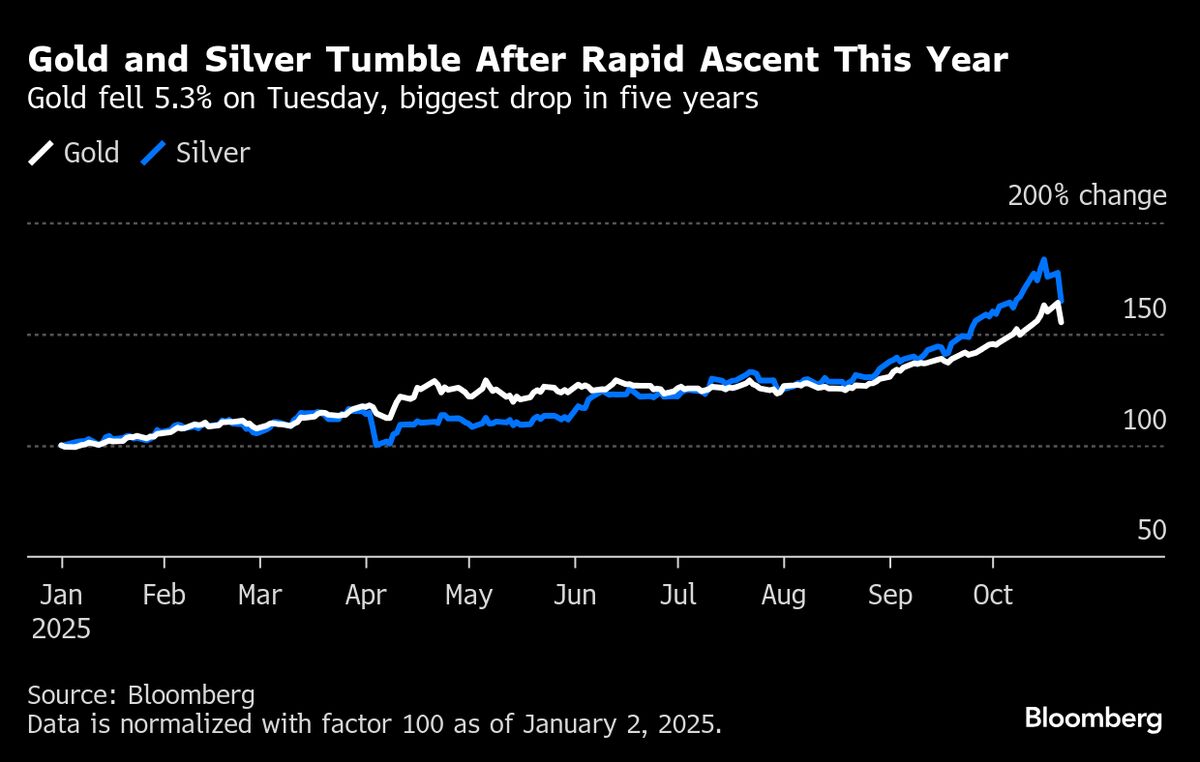

Gold, Silver Hold Losses as Stocks Take a Breather: Markets Wrap

NeutralFinancial Markets

Gold and silver prices have stabilized after experiencing significant drops from their record highs earlier this week. Meanwhile, US stocks are showing signs of a slowdown in their recent rally. This situation is noteworthy as it reflects the current volatility in the markets, impacting investors' strategies and decisions.

— Curated by the World Pulse Now AI Editorial System