Texas Instruments Signals That Chip Recovery Is Slowing

NegativeFinancial Markets

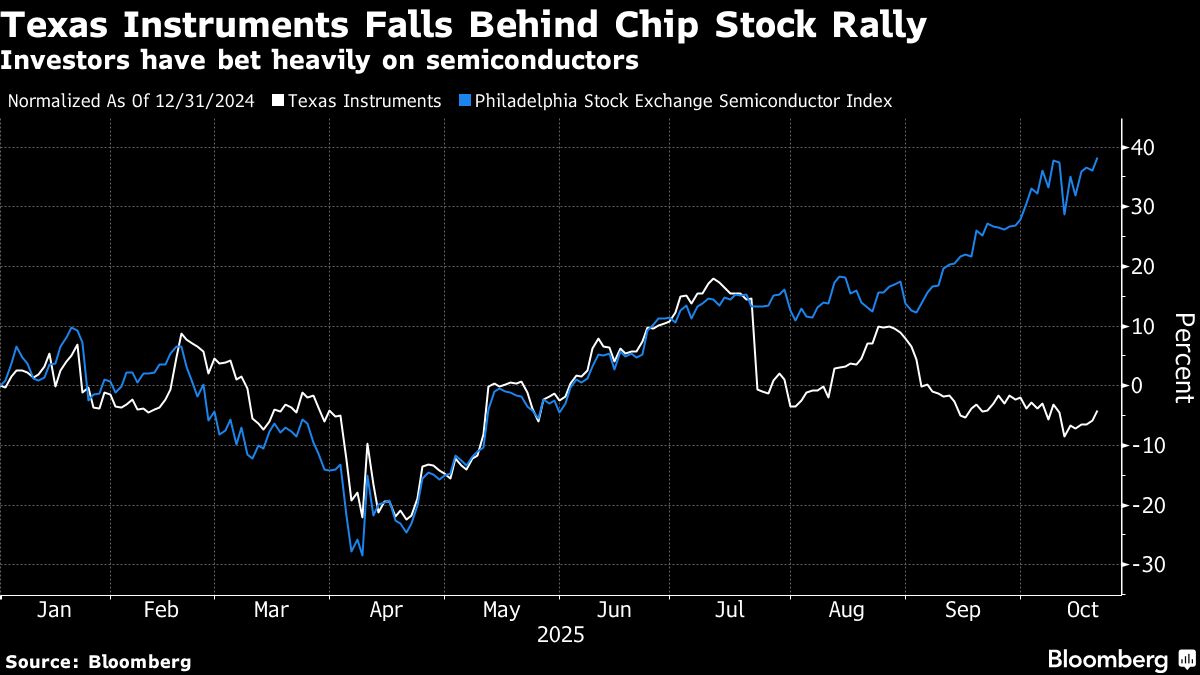

Texas Instruments, the leading manufacturer of analog chips, has issued a disappointing forecast for the upcoming period, raising alarms about a potential slowdown in the semiconductor industry's recovery. This news is significant as it reflects broader challenges within the tech sector, which relies heavily on chip production for various applications.

— Curated by the World Pulse Now AI Editorial System