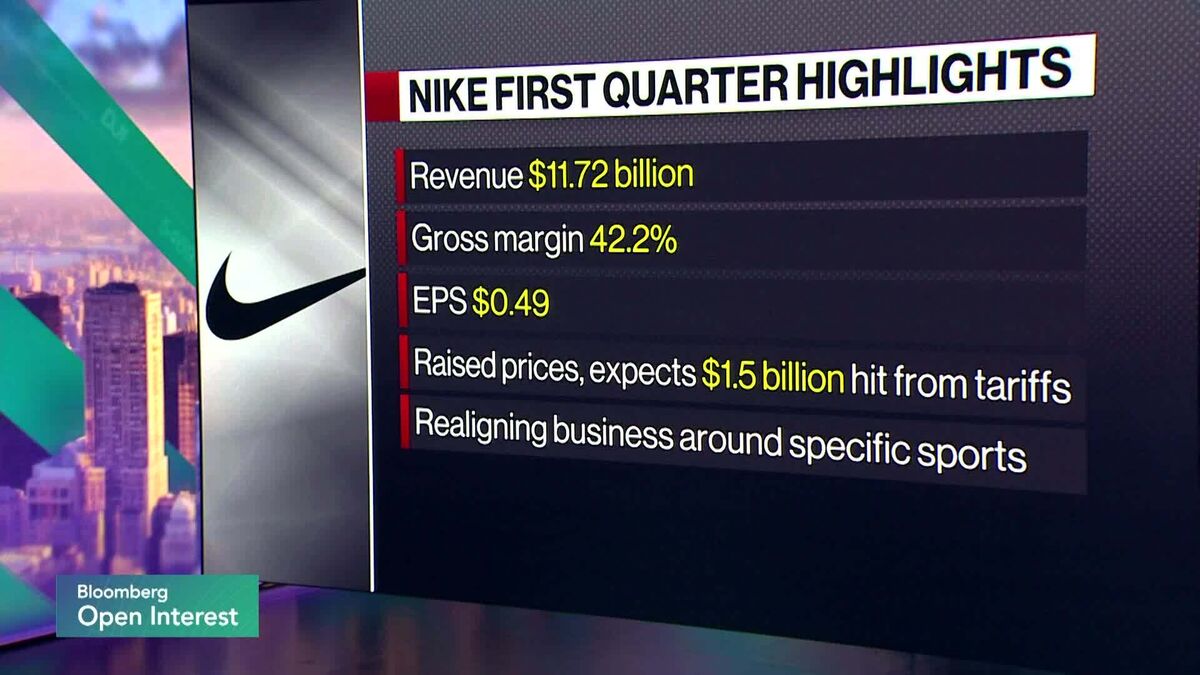

Nike Earnings Beat, Running Sales Surge

PositiveFinancial Markets

Nike's recent earnings report has sparked optimism as the company surpassed expectations, particularly with a notable 20% increase in running product sales in North America. This growth is significant as it highlights Nike's ability to adapt and thrive in a competitive market. However, challenges such as declining sales in China and tariffs remain, which could impact future performance. Analyst Cristina Fernandez from Telsey Group discussed these hurdles on Bloomberg, emphasizing the need for Nike to navigate these issues carefully.

— Curated by the World Pulse Now AI Editorial System