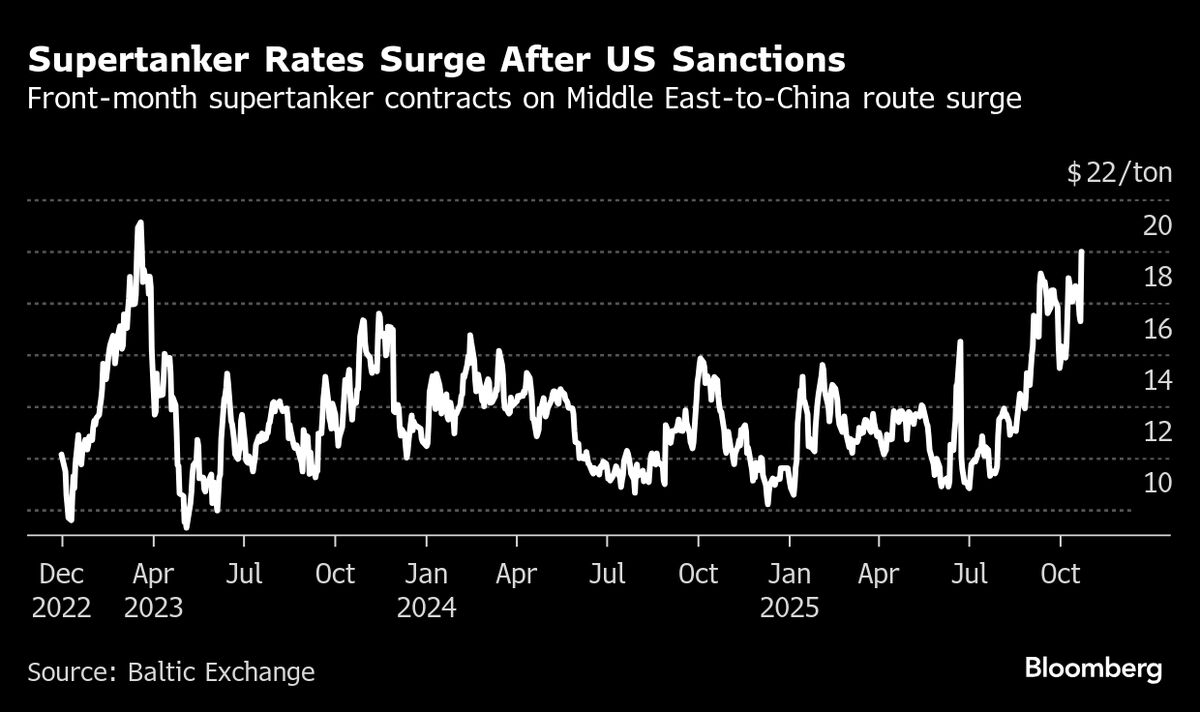

Rush to Replace Russian Oil Sees Supertanker Freight Rates Jump

PositiveFinancial Markets

The recent surge in supertanker freight rates highlights the significant impact of US sanctions on Russian oil producers. As buyers scramble to find alternatives, this shift not only affects the oil market but also indicates a broader change in global energy dynamics. The rising costs of shipping crude could lead to increased prices for consumers, making it a crucial development to watch.

— Curated by the World Pulse Now AI Editorial System