Wall Street Week | Larry Summers on the Fed, Argentina Elections, Hinton on AI, Trump’s H-1B Fee

NeutralFinancial Markets

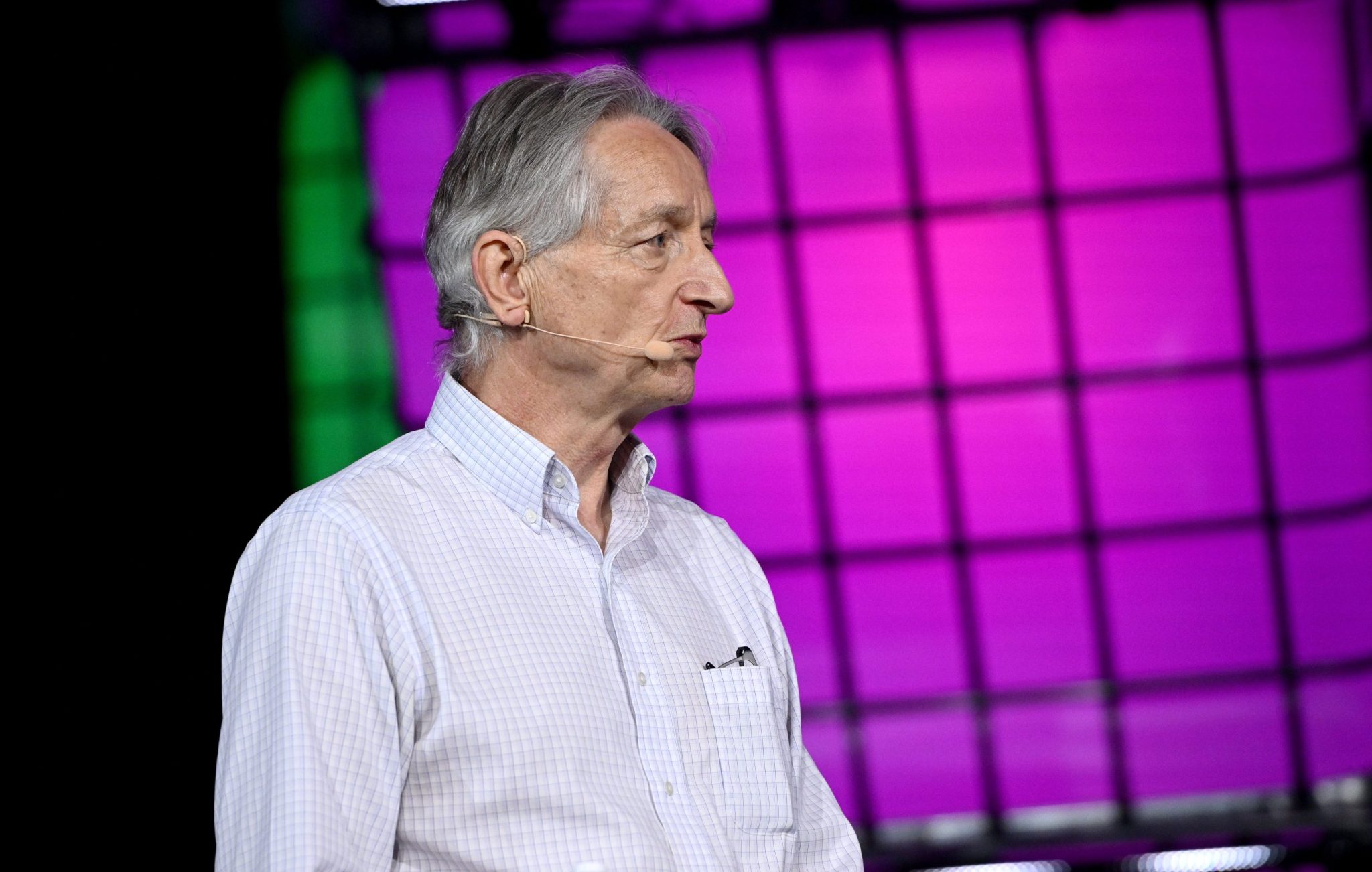

This week, former US Treasury Secretary Lawrence H. Summers discussed the Federal Reserve's cautious stance on potential rate cuts, emphasizing the importance of careful economic management. Meanwhile, Argentina's President Javier Milei is gaining support for his economic reforms following recent midterm elections, despite mixed results. Additionally, Geoffrey Hinton, known as the 'Godfather of AI,' raised concerns about the rapid advancement of artificial intelligence outpacing regulatory measures, highlighting the need for humanity to address these challenges. These discussions are crucial as they reflect ongoing economic strategies and the implications of technological advancements.

— Curated by the World Pulse Now AI Editorial System