The Little-Known Crypto Powerhouse Behind Billions in Trading

PositiveFinancial Markets

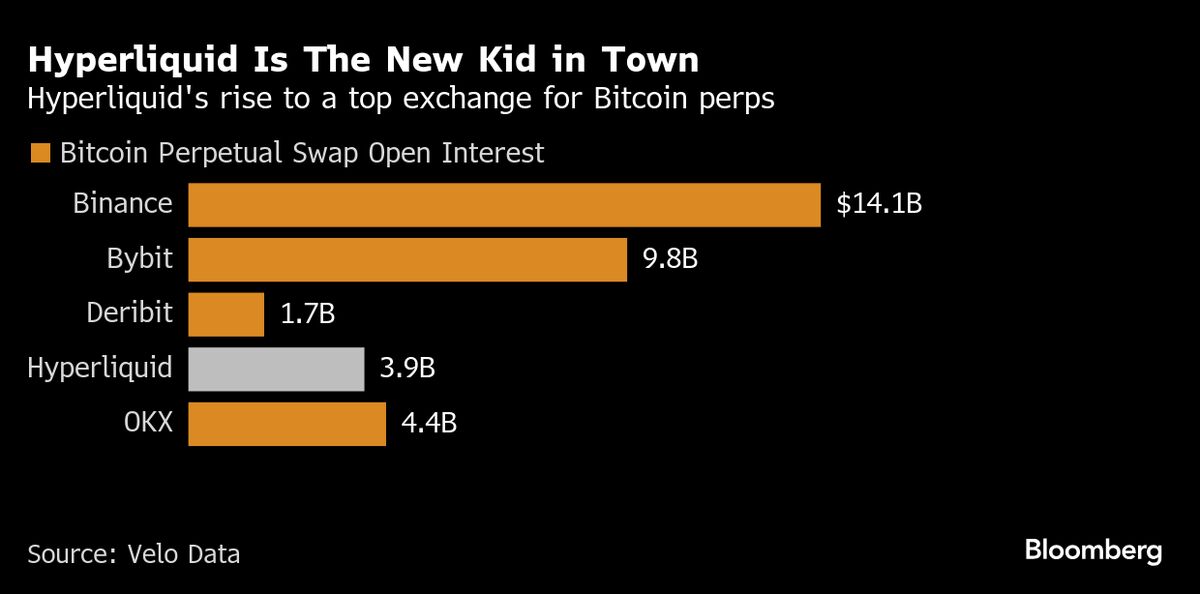

A little-known decentralized exchange has rapidly gained attention, attracting heavyweight investors and achieving billions in trading volume within just two years. This remarkable growth highlights the potential of innovative financial technologies and the increasing interest in cryptocurrency markets, making it a significant player in the evolving landscape of digital finance.

— Curated by the World Pulse Now AI Editorial System