Bitcoin hovers near all-time high

PositiveFinancial Markets

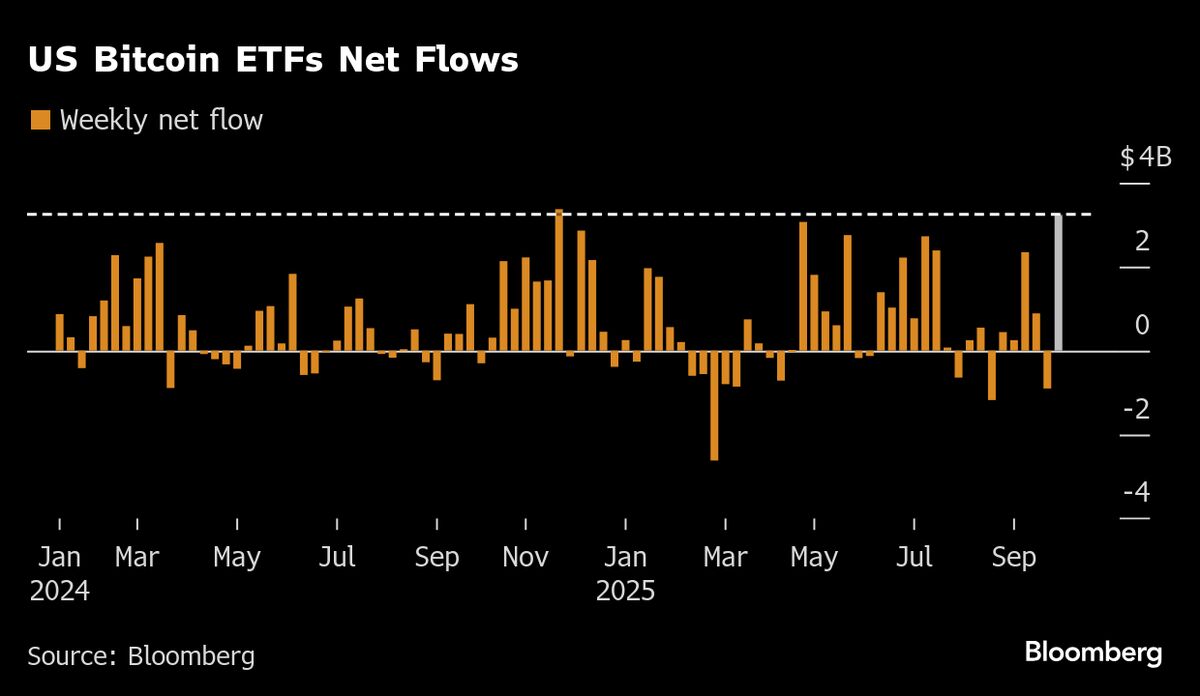

Bitcoin is currently hovering near its all-time high, sparking excitement among investors and analysts alike. This surge in value reflects growing confidence in the cryptocurrency market, as more people are looking to invest in digital assets. The implications of this trend are significant, as it could lead to increased adoption of cryptocurrencies and potentially reshape the financial landscape.

— Curated by the World Pulse Now AI Editorial System