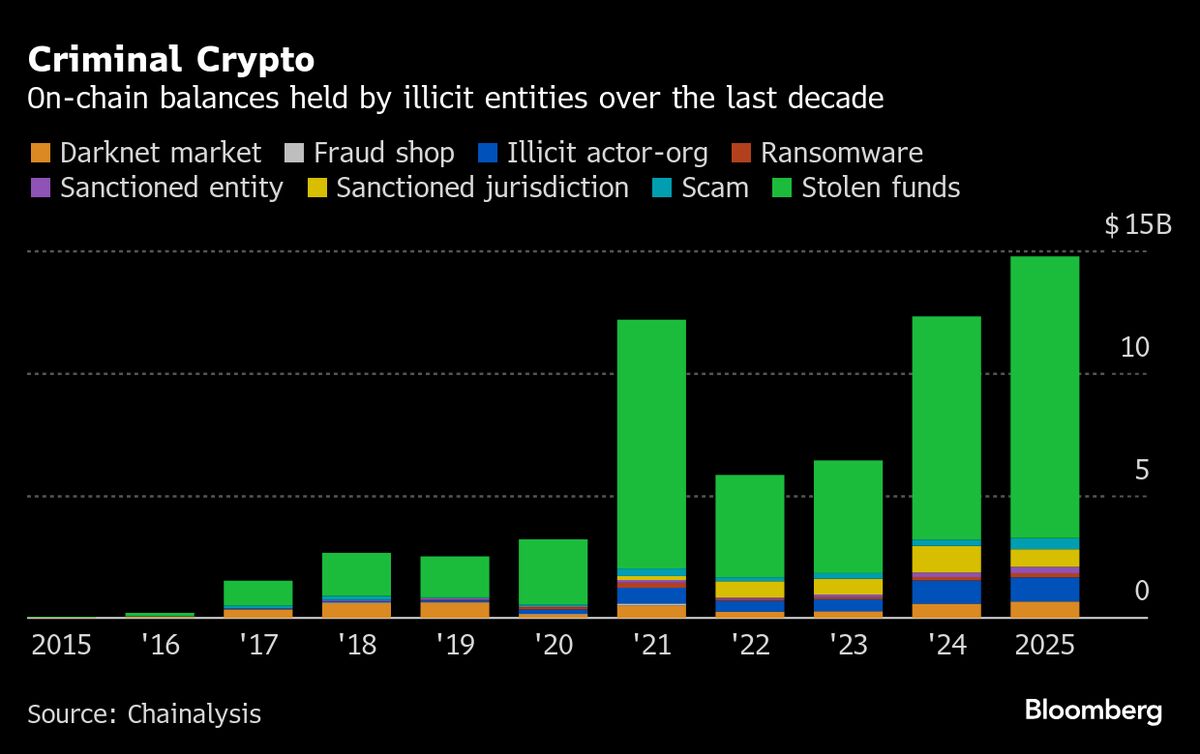

Governments Weighing Crypto Reserves Target $75 Billion Pot

PositiveFinancial Markets

Governments around the world, led by Donald Trump, are exploring the idea of creating a strategic crypto reserve using assets seized from criminals, aiming for a target of $75 billion. This initiative is significant as it reflects a growing recognition of cryptocurrencies like Bitcoin and their potential to contribute to economic growth. By tapping into these digital assets, governments hope to bolster their financial strategies and adapt to the evolving economic landscape.

— Curated by the World Pulse Now AI Editorial System