Gold prices scale record highs as investors seek safe haven

PositiveFinancial Markets

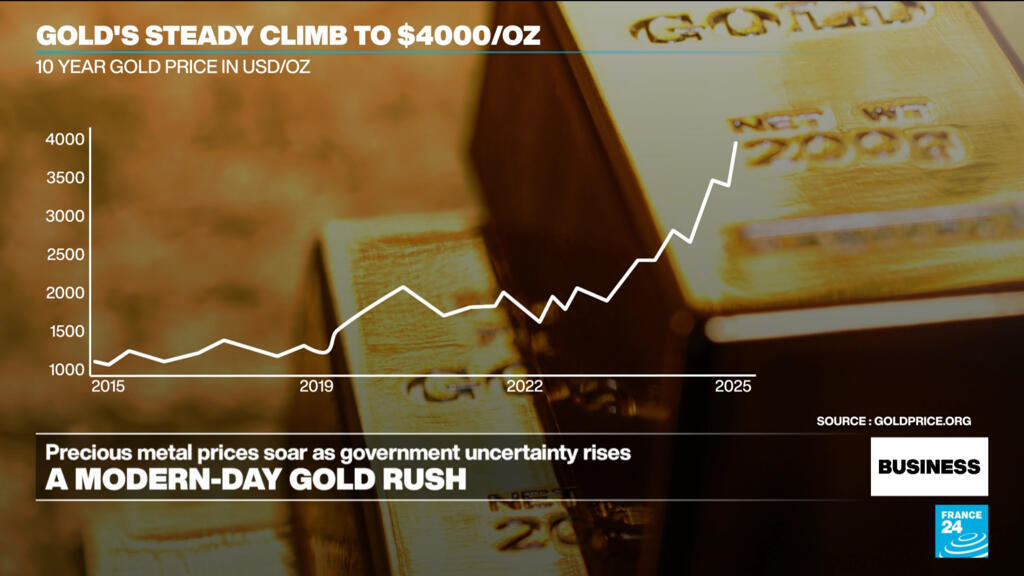

Gold prices have reached record highs, surpassing $4,000 per ounce for the first time, as investors flock to this precious metal amid a US government shutdown and economic uncertainty. This surge reflects a growing trend where individuals seek safe havens for their investments during turbulent times, highlighting gold's enduring appeal as a stable asset.

— Curated by the World Pulse Now AI Editorial System