Analysis-After trade truce, China becomes a bit more investible

PositiveFinancial Markets

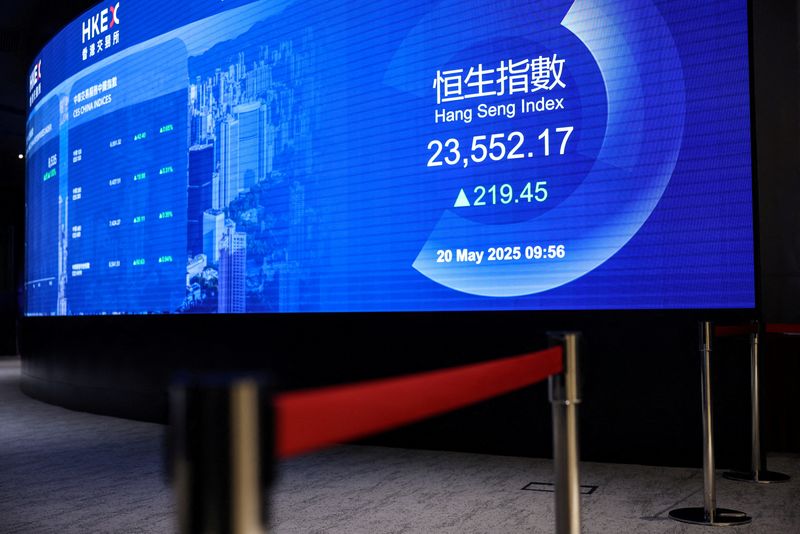

Recent analysis indicates that following a trade truce, China is becoming increasingly attractive for investors. This shift is significant as it suggests a more stable economic environment, potentially leading to greater foreign investment and economic growth. Investors are keen to explore opportunities in China, which could have positive implications for global markets.

— Curated by the World Pulse Now AI Editorial System