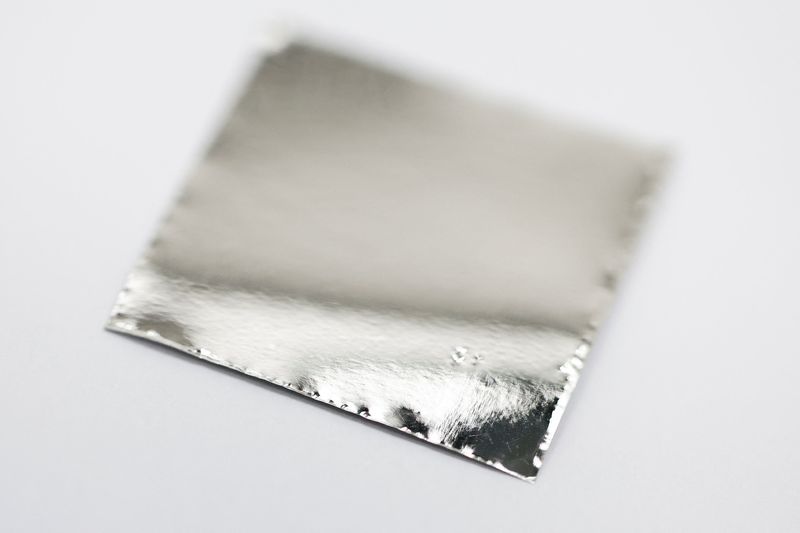

Analysts raise 2026 price forecasts for platinum, palladium after 2025 rally

PositiveFinancial Markets

Analysts are optimistic about the future of platinum and palladium prices, raising their forecasts for 2026 following a strong rally in 2025. This positive outlook is significant as it reflects growing demand and potential market shifts, which could impact investors and industries reliant on these precious metals. Understanding these trends is crucial for stakeholders looking to navigate the evolving landscape of metal investments.

— Curated by the World Pulse Now AI Editorial System