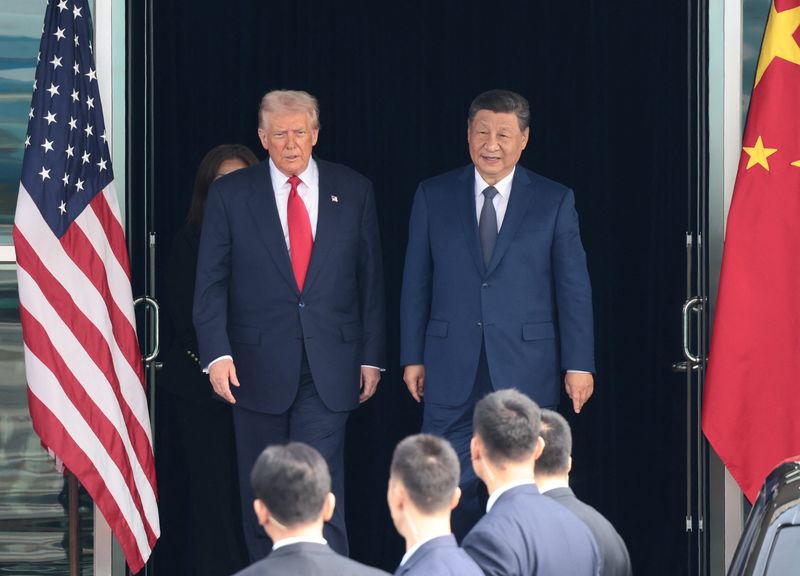

Analysis-Trump-Xi 'amazing' summit brings tactical truce, not major reset

NeutralFinancial Markets

The recent summit between Trump and Xi has been described as 'amazing,' marking a tactical truce rather than a significant reset in relations. This meeting is important as it highlights ongoing diplomatic efforts between the two leaders amidst global tensions, suggesting a willingness to engage in dialogue despite underlying issues.

— Curated by the World Pulse Now AI Editorial System