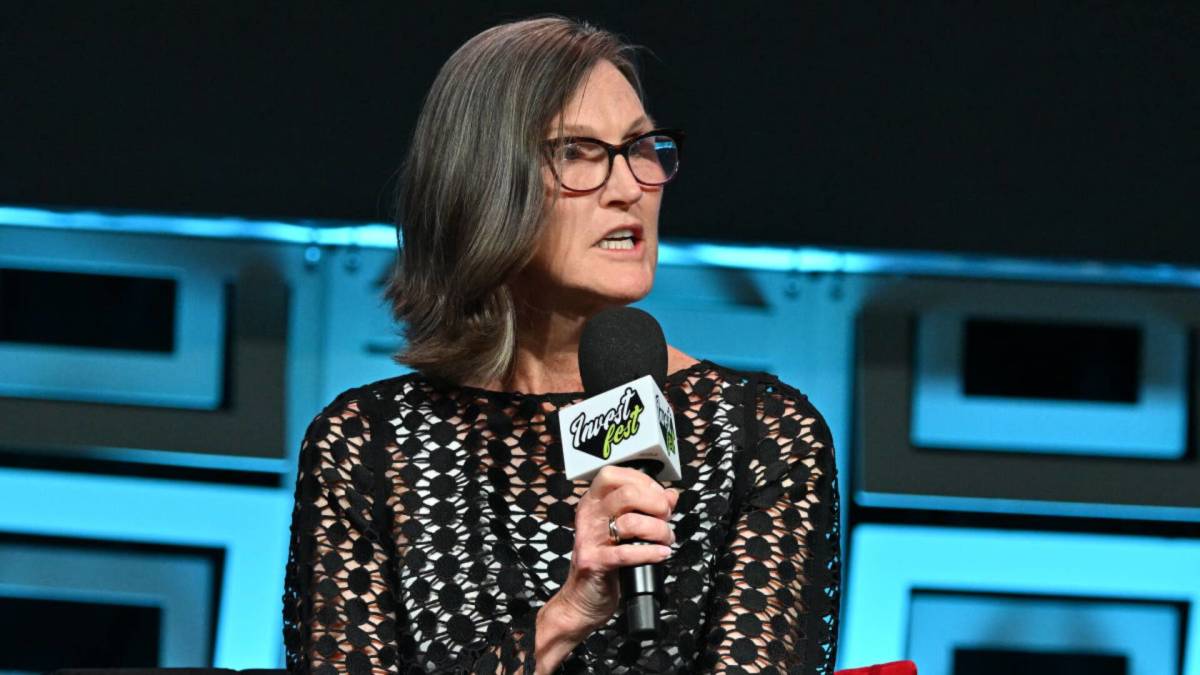

Cathie Wood sells $8 million of popular tech stock

PositiveFinancial Markets

Cathie Wood, the head of Ark Investment Management, has recently sold $8 million worth of a popular tech stock, showcasing her dynamic investment strategy. Known for adjusting her positions based on market movements, Wood's approach has proven effective during the recent market rally, allowing her funds to benefit significantly. This highlights her ability to navigate the market's ups and downs while maintaining a long-term vision, making her a key figure to watch in the investment world.

— Curated by the World Pulse Now AI Editorial System