BlackRock’s private credit arm seeks recovery in alleged $500 million fraud - WSJ

NegativeFinancial Markets

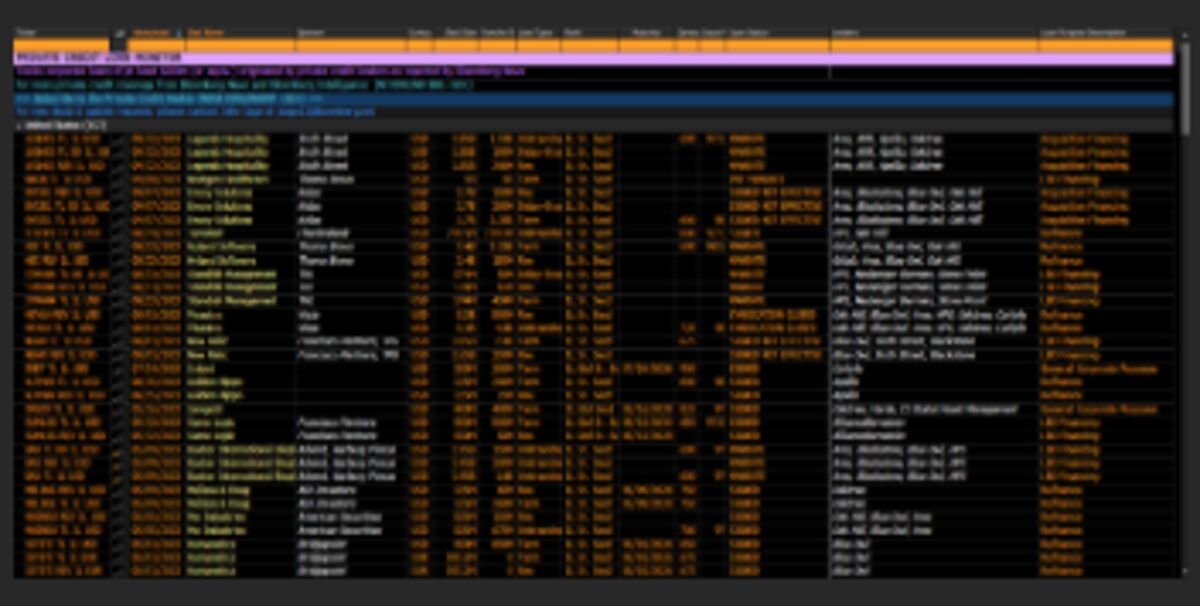

BlackRock's private credit division is embroiled in a significant legal battle as it seeks to recover losses from an alleged $500 million fraud. This situation highlights the risks associated with private credit investments and raises questions about due diligence in financial practices. The outcome could have broader implications for the industry, affecting investor confidence and regulatory scrutiny.

— Curated by the World Pulse Now AI Editorial System