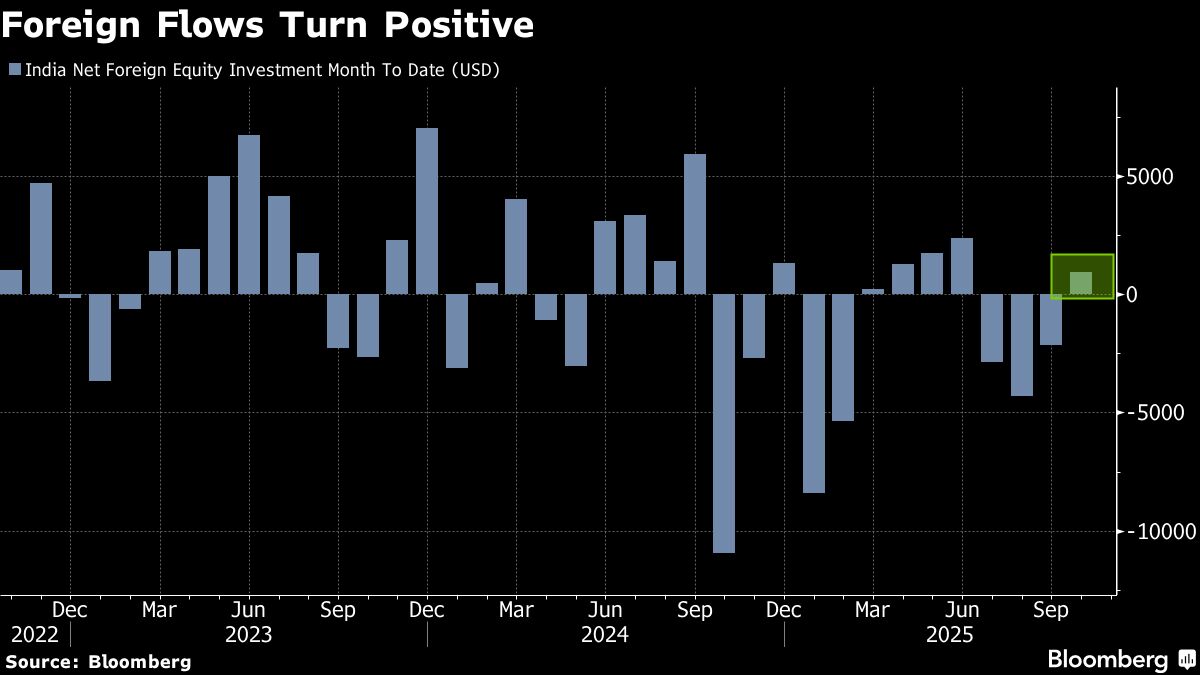

Indian Stocks Set to Start Week on Cheerful Note Ahead of Diwali

PositiveFinancial Markets

Indian stocks are poised to begin the week on a positive note as traders anticipate a cheerful atmosphere leading up to Diwali. This festive season often brings optimism in the markets, and investors are keen to see how key news and events will influence trading. The upbeat sentiment reflects a broader confidence in the economy, making it an exciting time for market participants.

— Curated by the World Pulse Now AI Editorial System