Trade Shifts to Avoid Highest US Tariffs Since 1930s

NeutralFinancial Markets

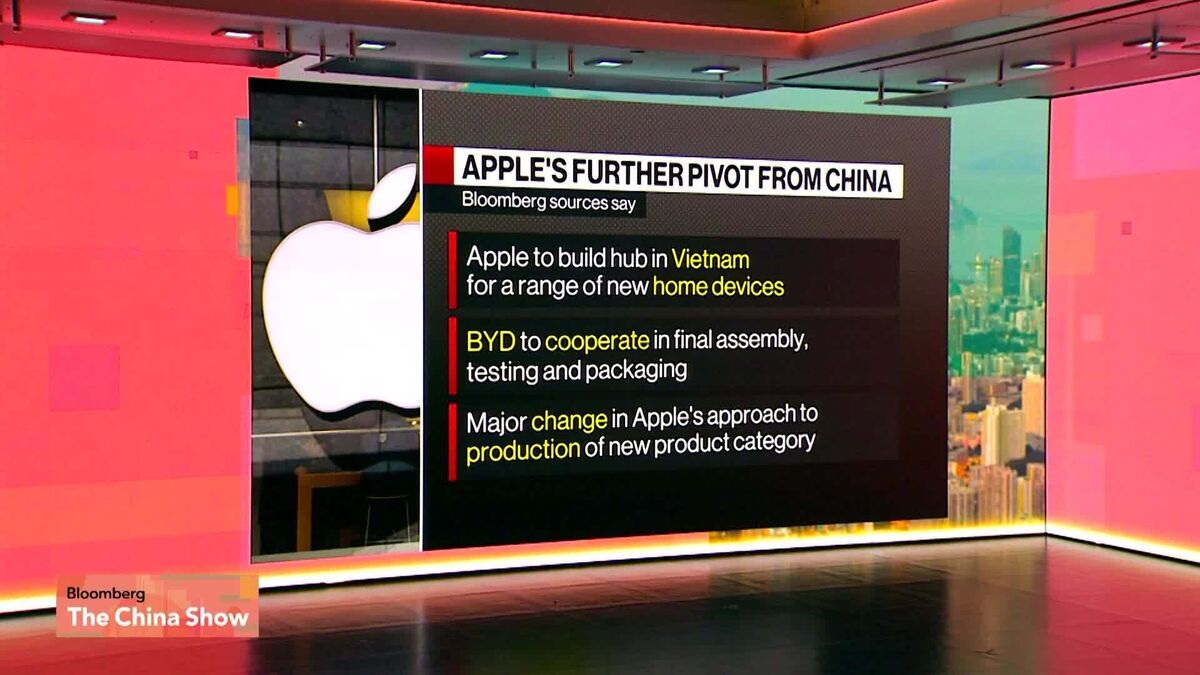

As US tariffs reach their highest levels since the 1930s, governments and companies are adjusting their strategies to navigate this new economic landscape. This shift is prompting a search for alternative markets, which could reshape global trade dynamics. Bloomberg's Enda Curran discusses these changes on 'Bloomberg Businessweek Daily', highlighting the importance of adapting to avoid increased costs for US consumers and businesses.

— Curated by the World Pulse Now AI Editorial System