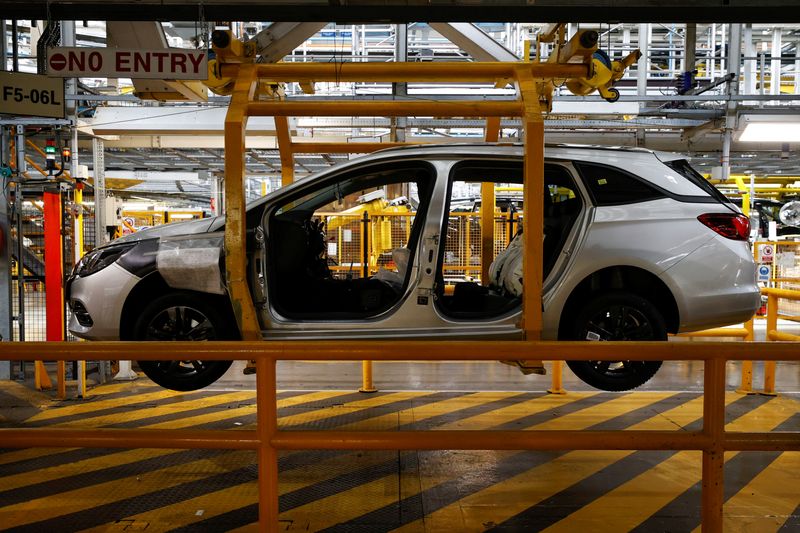

UK manufacturing shrinks at fastest pace in 5 months, PMI shows

NegativeFinancial Markets

The latest PMI data reveals that UK manufacturing has contracted at its fastest rate in five months, raising concerns about the overall health of the economy. This decline is significant as it indicates potential challenges for businesses and could impact job growth and investment. Understanding these trends is crucial for policymakers and industry leaders as they navigate the economic landscape.

— Curated by the World Pulse Now AI Editorial System