Trump-Xi Truce, Meta's Record Bond Sale | Bloomberg Businessweek Daily 10/30/2025

PositiveFinancial Markets

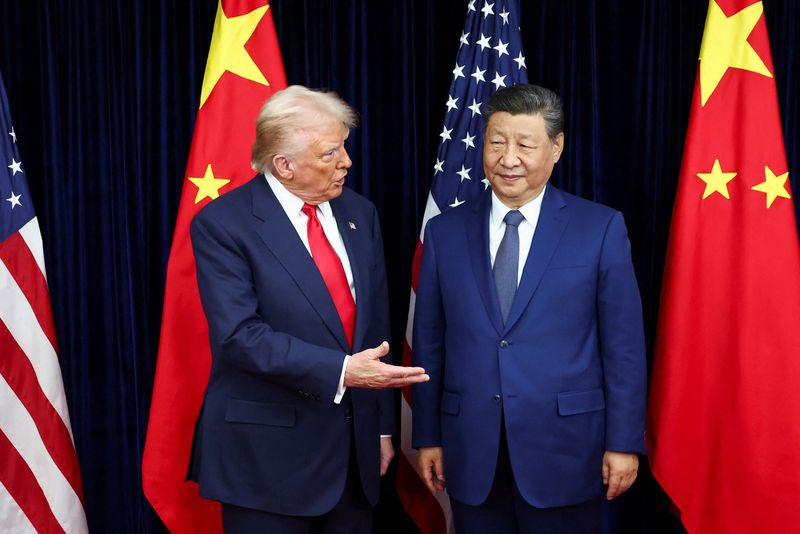

In today's Bloomberg Businessweek Daily, hosts Carol Massar and Tim Stenovec highlight Meta's impressive jumbo bond sale, which comes on the heels of CEO Mark Zuckerberg's announcement of aggressive AI investments. This move signals Meta's commitment to innovation and growth in a competitive tech landscape. Additionally, the episode features insights from UC San Diego's Caroline Freund on President Trump's recent meeting with Chinese President Xi Jinping, emphasizing the importance of international relations in today's economy. These developments are crucial as they reflect the evolving dynamics of business and politics.

— Curated by the World Pulse Now AI Editorial System