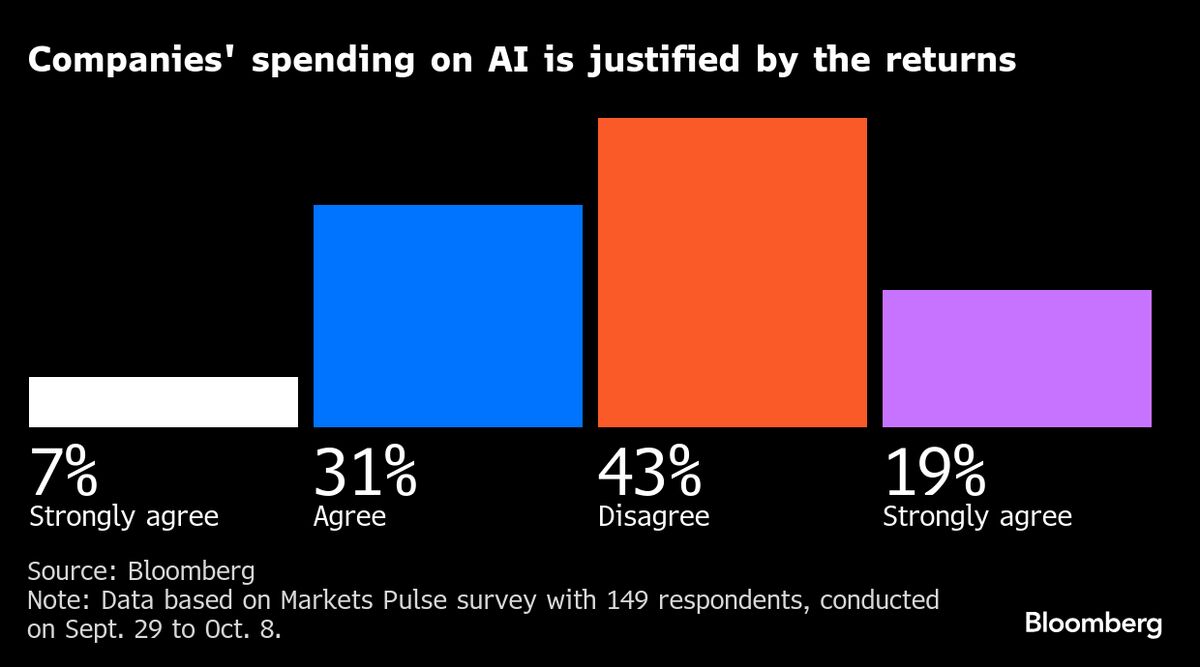

Companies Overpaying for AI Add to Bubble Risks, Survey Shows

NegativeFinancial Markets

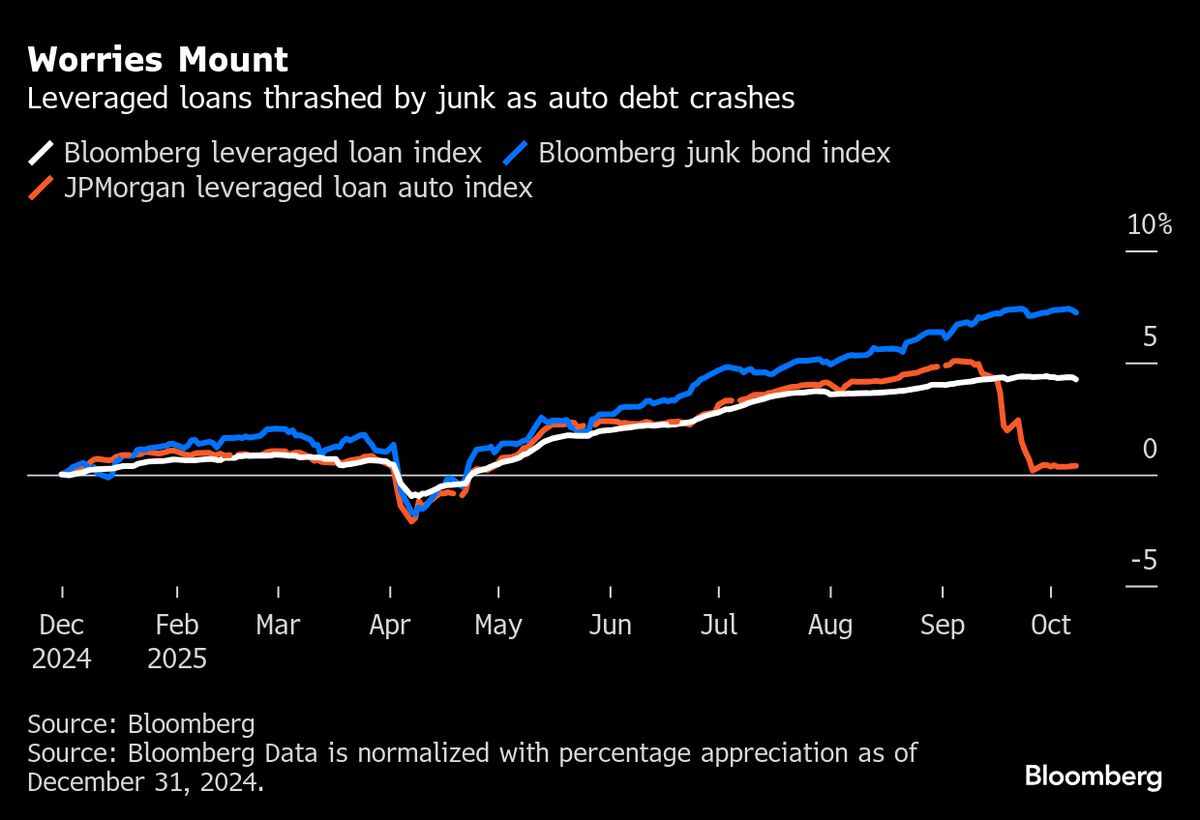

A recent Markets Pulse survey reveals that companies may be overpaying for artificial intelligence, raising concerns about the sustainability of the current market rally, which has reached $16 trillion. This skepticism about the value of AI investments could signal that the market is nearing a breaking point, prompting investors to reconsider their strategies. Understanding these dynamics is crucial as they could impact future investments and the overall economic landscape.

— Curated by the World Pulse Now AI Editorial System