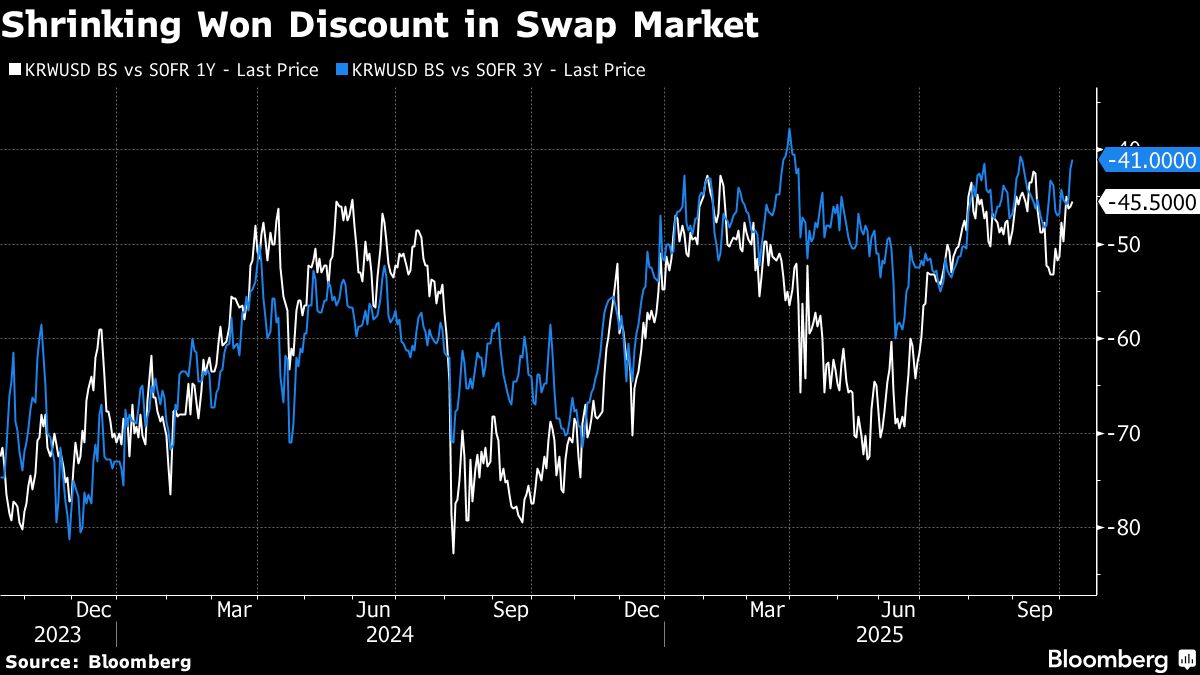

Offshore Funds Boost Won Hedges on Trade Angst, Hana Bank Says

PositiveFinancial Markets

Foreign investors are increasingly turning to South Korean won hedges, driven by concerns that the currency market hasn't fully accounted for potential risks associated with a significant $350 billion investment linked to a trade deal with the US. This trend highlights the growing confidence in the won's stability and the importance of international investments in bolstering the South Korean economy.

— Curated by the World Pulse Now AI Editorial System