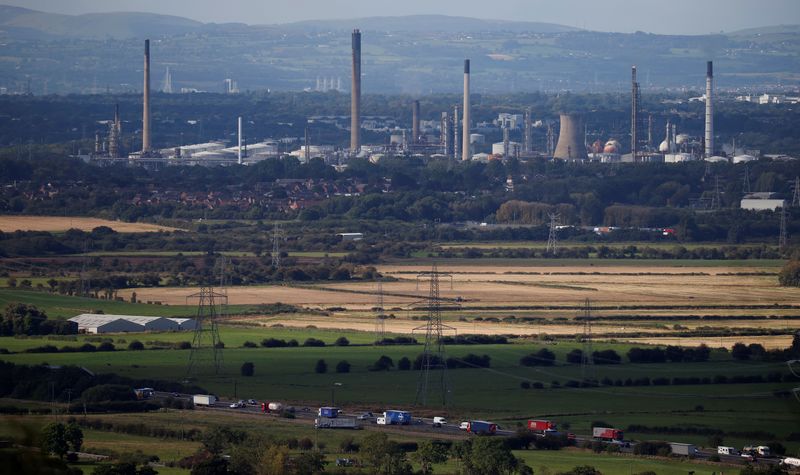

European oil refineries bet on green projects to secure long-term future

PositiveFinancial Markets

European oil refineries are increasingly investing in green projects to ensure their long-term viability in a rapidly changing energy landscape. This shift is crucial as the world moves towards sustainability and seeks to combat climate change. By diversifying their operations and focusing on renewable energy sources, these refineries are not only securing their future but also contributing to a more sustainable energy system. This trend highlights the industry's adaptability and commitment to environmental responsibility.

— Curated by the World Pulse Now AI Editorial System