Fed’s Bowman: New Stress Test Proposals Unveiled Soon

PositiveFinancial Markets

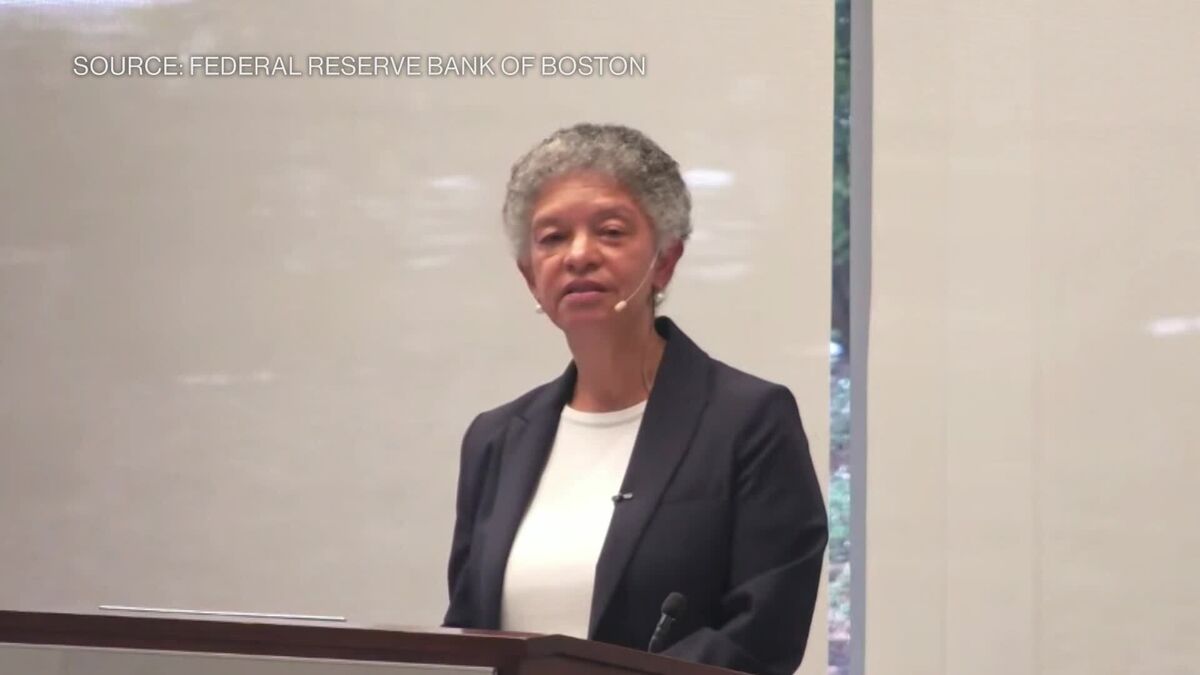

Federal Reserve Vice Chair for Supervision Michelle Bowman has announced that she will soon reveal new proposals for stress tests, which are crucial for ensuring the stability of the banking system. This comes as negotiations on the US version of the Basel III endgame are underway. Bowman's remarks at the Institute of International Finance’s annual gathering in Washington highlight the Fed's commitment to enhancing financial oversight, which is vital for maintaining public confidence in the banking sector.

— Curated by the World Pulse Now AI Editorial System