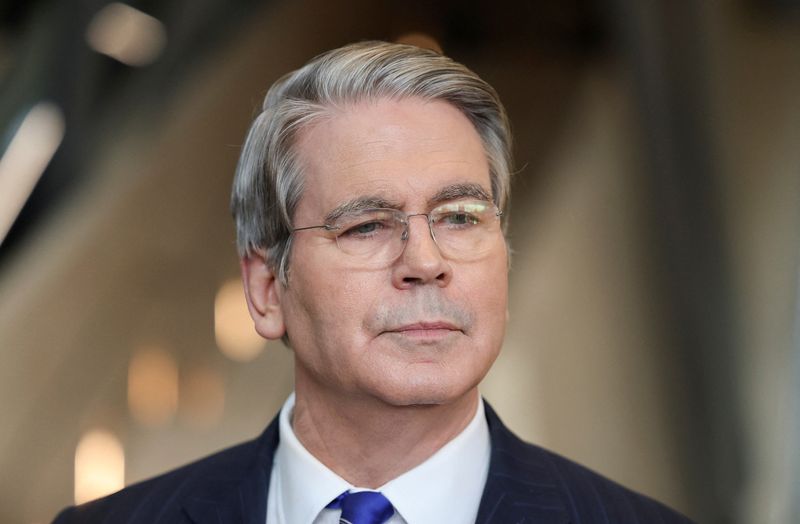

General Atlantic's Caillux on IPO Market Activity

PositiveFinancial Markets

Gabriel Caillaux, Co-President of General Atlantic, recently shared insights with Bloomberg about the growing investment momentum in the Middle East, where they've invested over $1.5 billion. Speaking at the Future Investment Initiative in Riyadh, he acknowledged the volatility in the tech IPO market but highlighted the significant opportunities arising from the shift to cloud technology. This is important as it reflects a broader trend of increasing investment in the region, which could lead to substantial economic growth and innovation.

— Curated by the World Pulse Now AI Editorial System