European, U.S. chipmakers push higher after ASML’s net bookings beat estimates

PositiveFinancial Markets

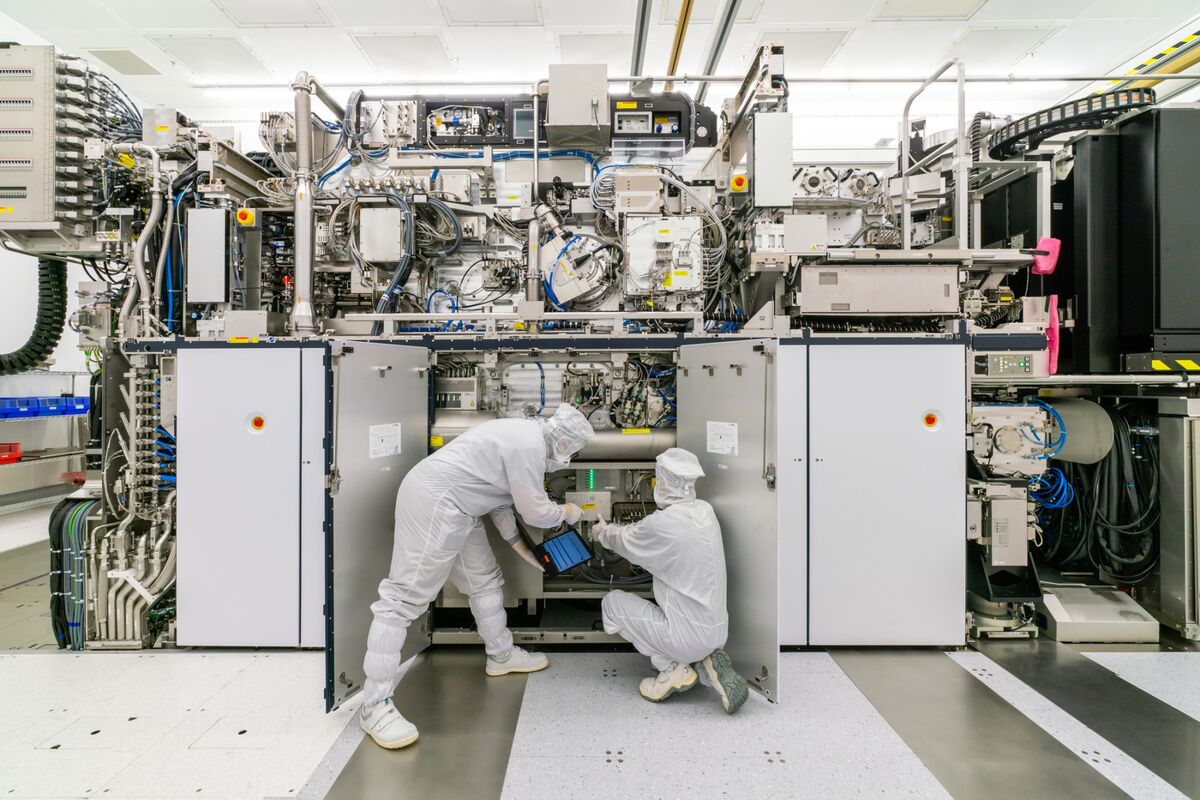

European and U.S. chipmakers are experiencing a surge in their stock prices following ASML's impressive net bookings that exceeded expectations. This positive news is significant as it reflects strong demand in the semiconductor industry, which is crucial for various sectors including technology and automotive. Investors are optimistic about the growth potential in this market, indicating a robust recovery and future opportunities for innovation.

— Curated by the World Pulse Now AI Editorial System