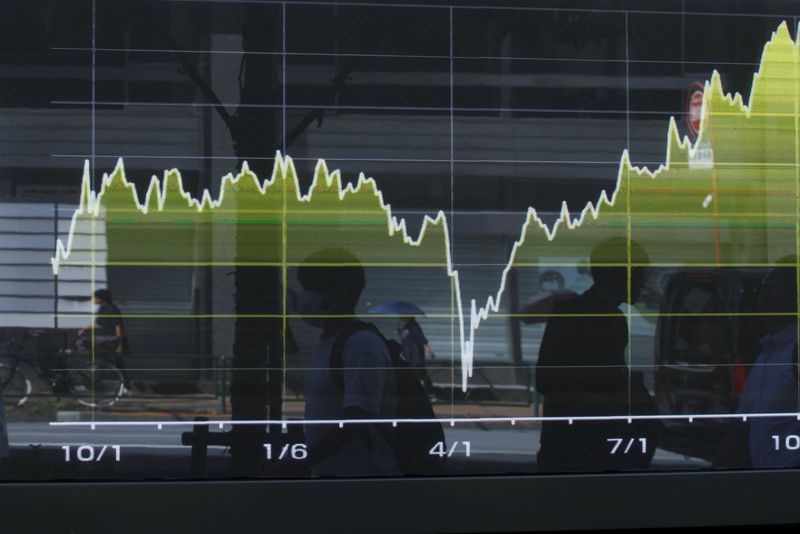

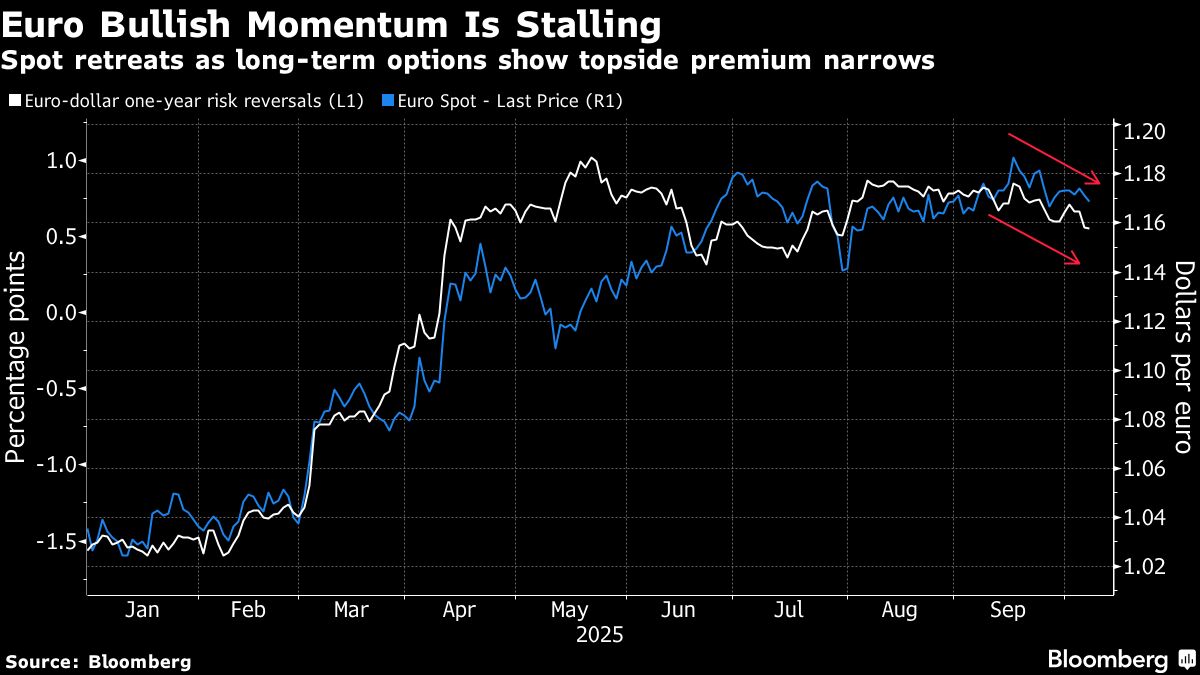

Yen, euro extend declines against dollar as politics dominates

NegativeFinancial Markets

The yen and euro have both seen declines against the dollar, largely influenced by ongoing political developments. This trend is significant as it reflects the impact of political stability and economic policies on currency values, which can affect international trade and investment. Investors are closely monitoring these changes, as they could signal broader economic shifts.

— Curated by the World Pulse Now AI Editorial System