Bond Traders Say Rally Hinges on Jobs Data at Risk From Shutdown

NeutralFinancial Markets

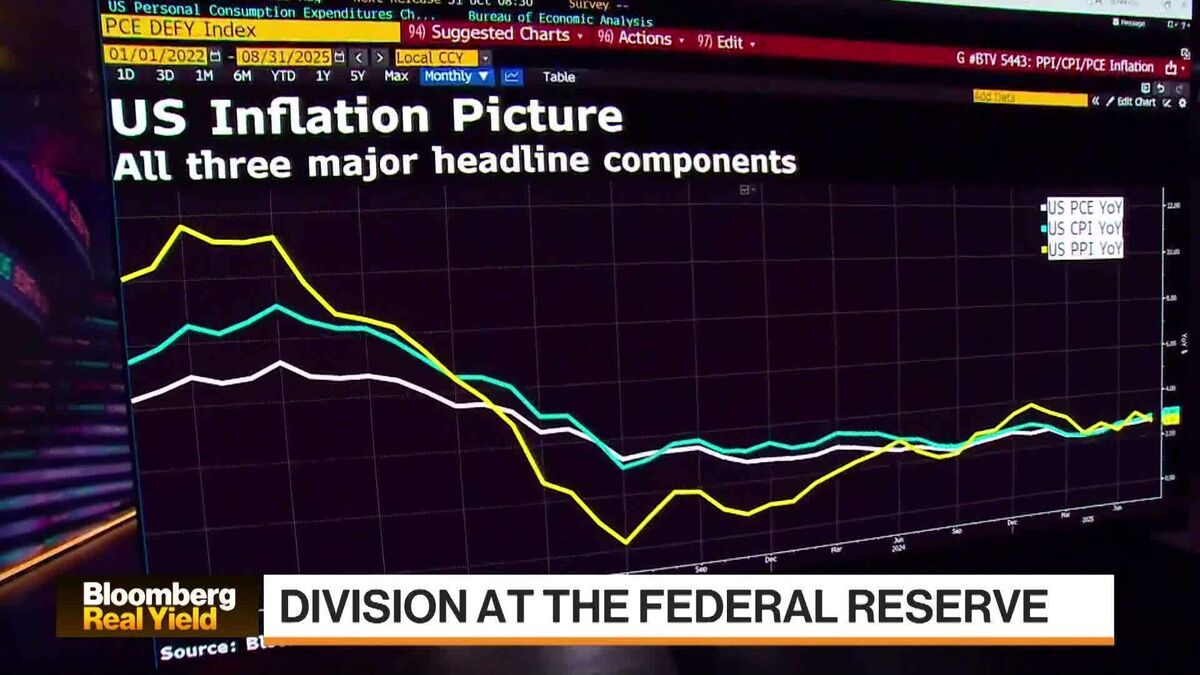

Bond traders are closely watching the upcoming US jobs report, as its results could significantly impact their confidence in the possibility of another interest-rate cut by the Federal Reserve in October. This situation is crucial for investors, as it may influence market trends and investment strategies in the near future.

— Curated by the World Pulse Now AI Editorial System