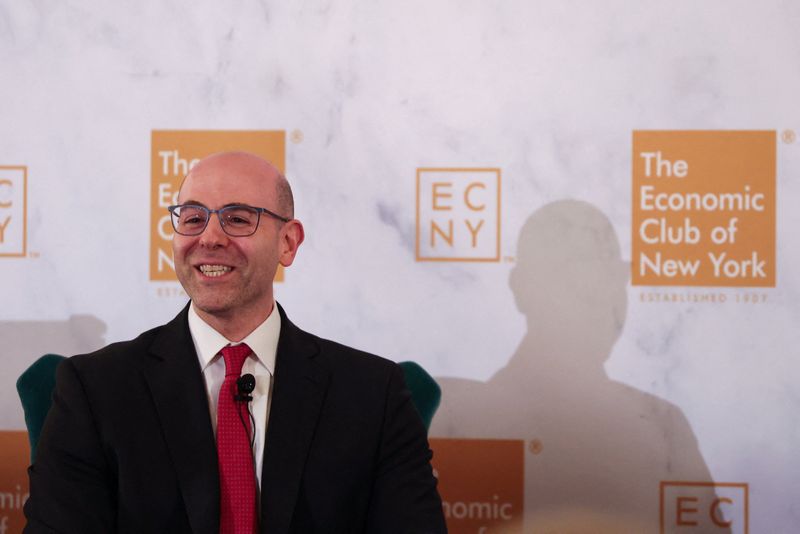

New York Fed’s John Williams Favors More Rate Cuts

PositiveFinancial Markets

John Williams, the president of the New York Federal Reserve, has expressed support for further interest rate cuts to stimulate economic growth. This is significant as it indicates a proactive approach to managing the economy, especially in light of recent challenges. By advocating for lower rates, Williams aims to encourage borrowing and investment, which could lead to job creation and a more robust economic recovery.

— Curated by the World Pulse Now AI Editorial System