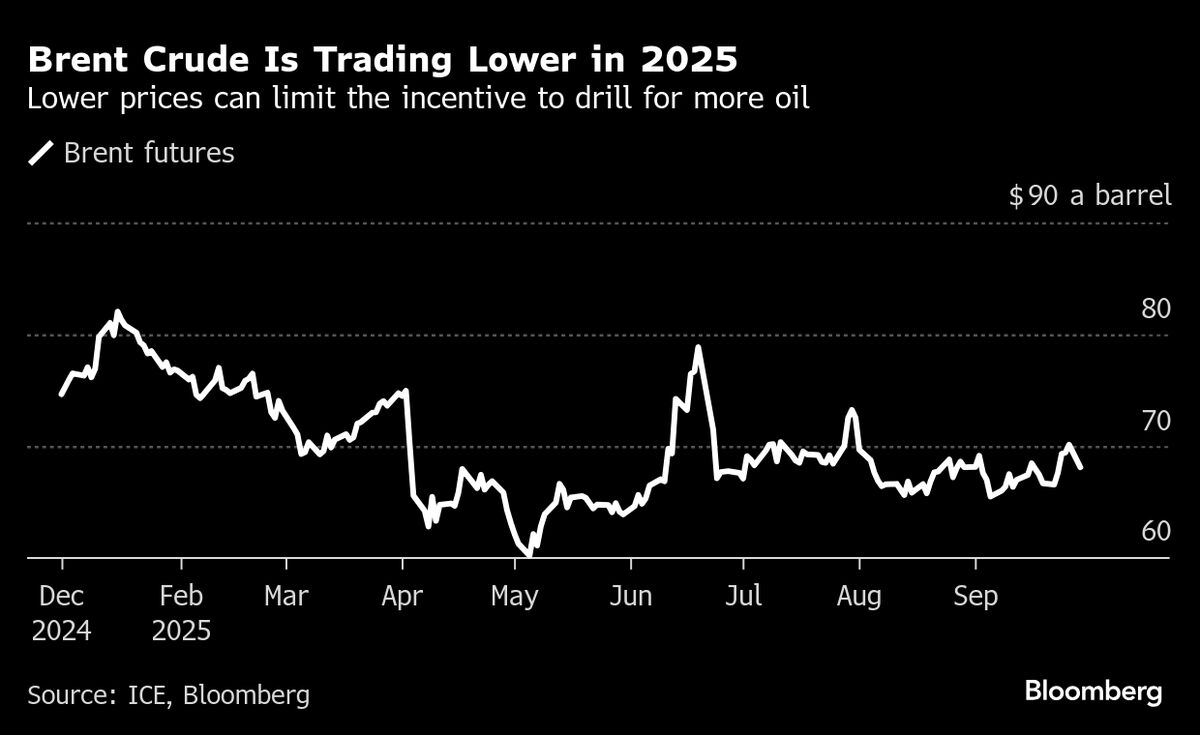

TotalEnergies price target lowered to €70 by RBC Capital on cautious outlook

NegativeFinancial Markets

RBC Capital has lowered its price target for TotalEnergies to €70, reflecting a cautious outlook on the company's future performance. This adjustment highlights concerns about market conditions and potential challenges facing the energy sector, which could impact investor confidence and the company's growth trajectory.

— Curated by the World Pulse Now AI Editorial System