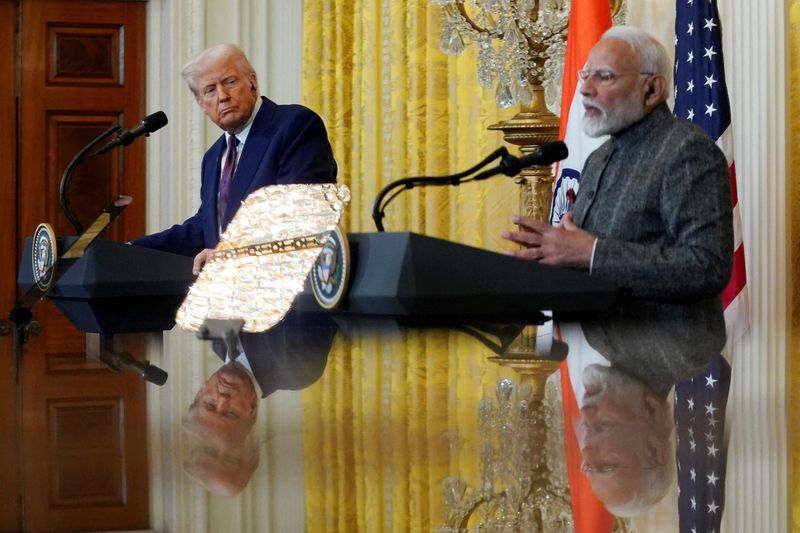

Powell says exactly what Wall Street wants to hear as Trump provokes soybean battle with China

PositiveFinancial Markets

Federal Reserve Chair Jerome Powell delivered a message that resonated well with investors, reinforcing their optimism about potential interest rate cuts. This positive sentiment comes at a time when tensions are rising between the U.S. and China over soybean trade, as President Trump stirs the pot. The combination of Powell's reassurances and the ongoing trade dynamics could significantly influence market movements, making it a crucial moment for investors.

— Curated by the World Pulse Now AI Editorial System