Goldman and Citi Split Over French Election Risks for Bonds

NeutralFinancial Markets

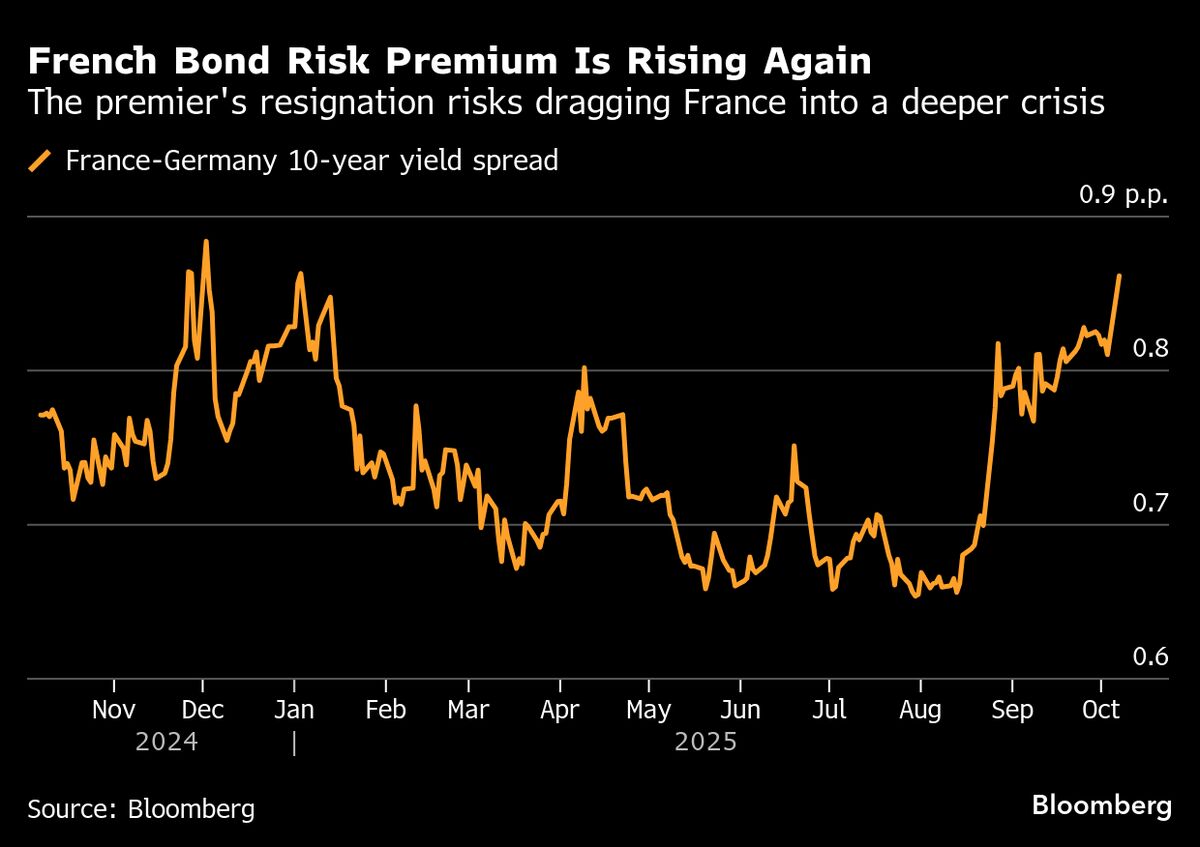

Goldman Sachs and Citigroup have differing opinions on the future of French bonds, particularly regarding the potential impact of new elections. This split highlights the uncertainty in the market as investors weigh the likelihood of political changes in France. Understanding these perspectives is crucial for investors as they navigate the complexities of the bond market.

— Curated by the World Pulse Now AI Editorial System