Funds Chase New Private Credit Money for Emerging-Market Bets

PositiveFinancial Markets

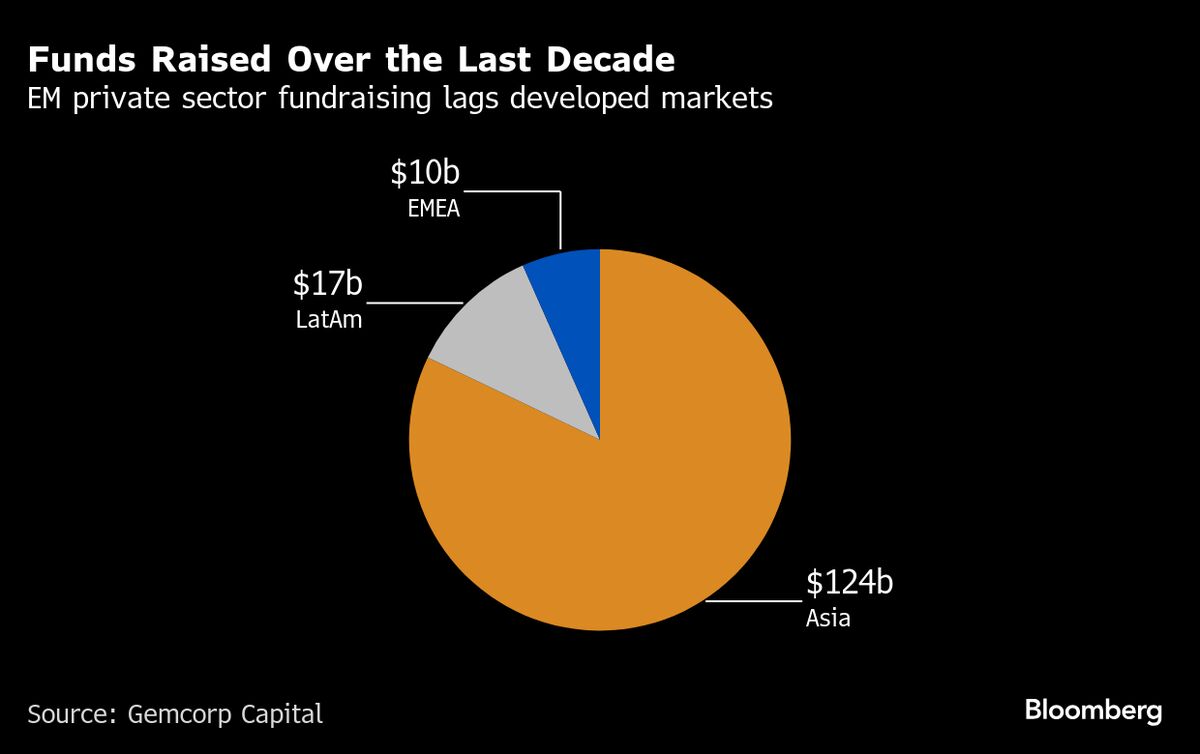

Asset managers are actively seeking to raise new private credit funds focused on emerging markets, driven by a surge in financing deals this year. This trend is significant as it highlights the growing interest and potential for investment in these markets, which could lead to increased economic development and opportunities for investors.

— Curated by the World Pulse Now AI Editorial System