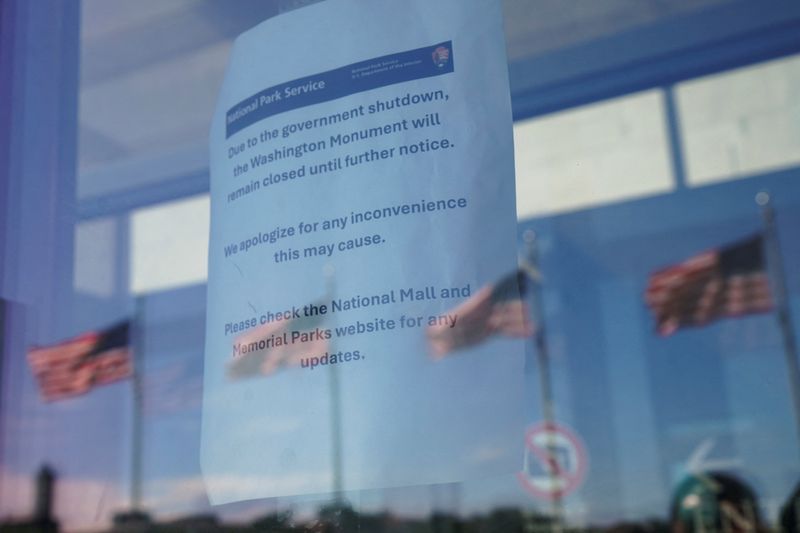

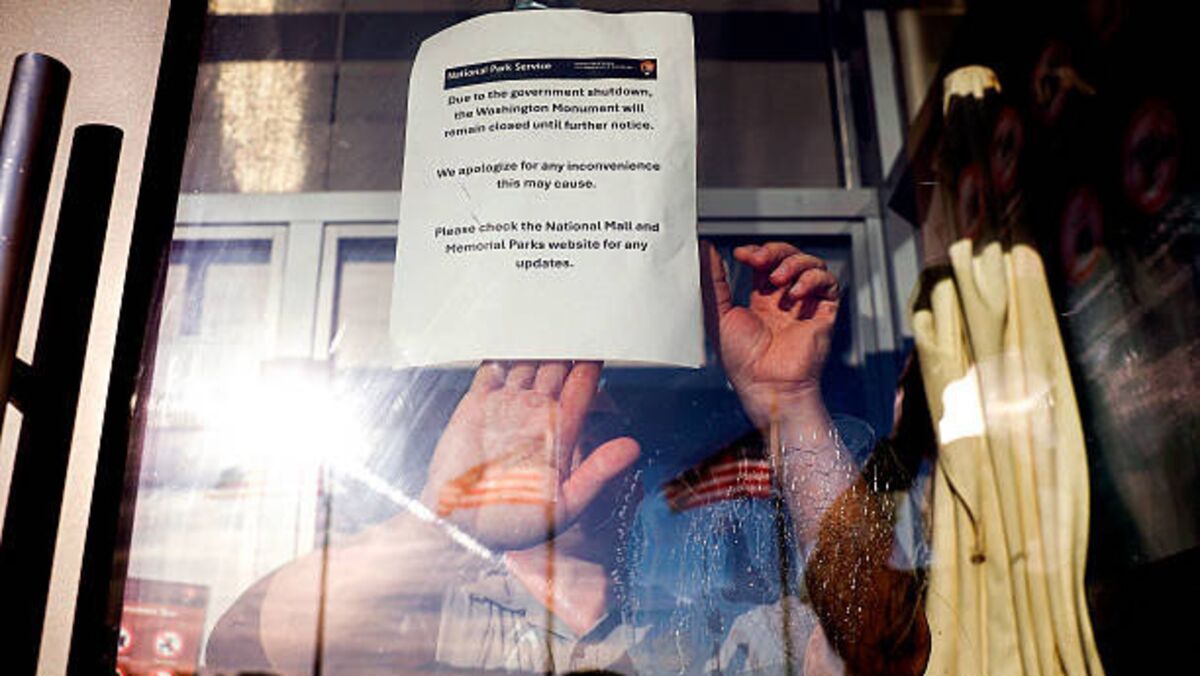

US Shutdown Begins With Each Party Blaming Each Other

NegativeFinancial Markets

The US government has officially shut down, leaving thousands of federal workers without pay as Democrats and Republicans engage in a blame game over the impasse. This situation not only affects government employees but also has broader implications for public services and the economy, highlighting the ongoing political divisions in Washington.

— Curated by the World Pulse Now AI Editorial System