OpenAI & AMD Ink Blockbuster Deal | Bloomberg Businessweek Daily 10/6/2025

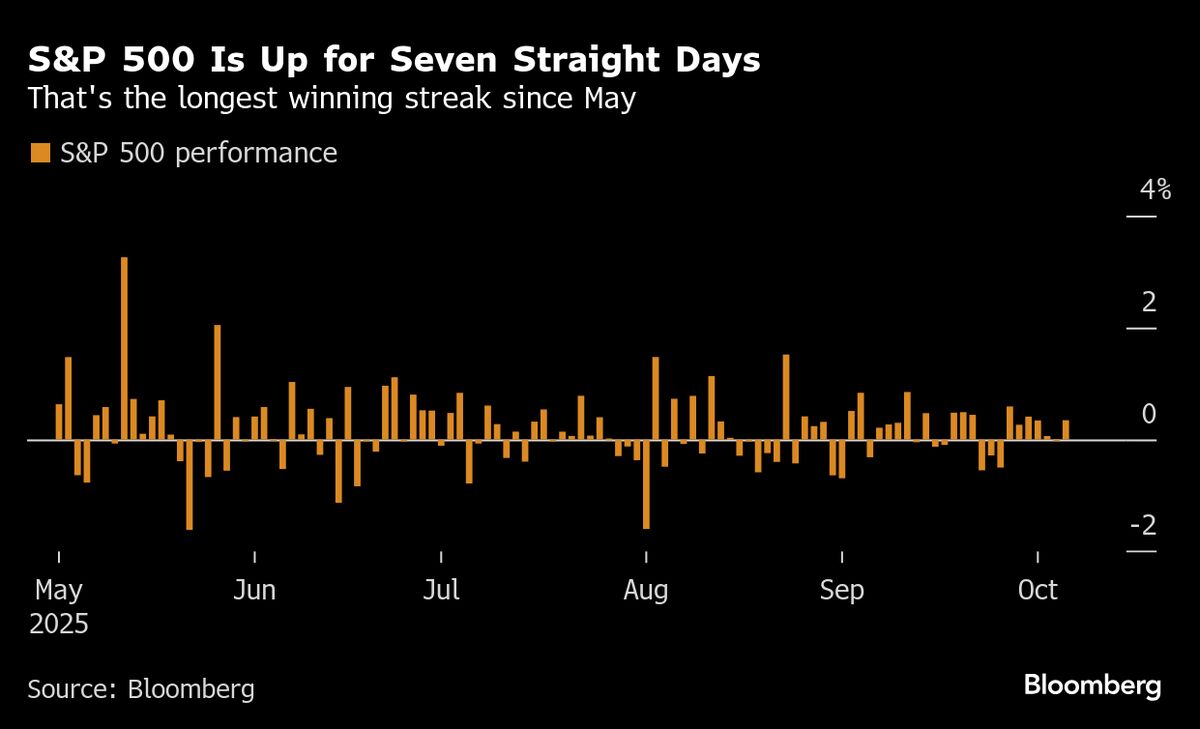

PositiveFinancial Markets

In a significant development, OpenAI has secured a massive deal with AMD for advanced chips worth tens of billions of dollars, marking a pivotal moment in the tech industry. This partnership is expected to enhance AI capabilities and drive innovation, showcasing the growing importance of powerful hardware in AI advancements. Meanwhile, political tensions in France are rising as President Emmanuel Macron gives his outgoing prime minister a tight deadline to negotiate with parties, highlighting the ongoing challenges in governance. This juxtaposition of tech progress and political strife illustrates the dynamic landscape we are navigating today.

— Curated by the World Pulse Now AI Editorial System