Banks in Good Position for Credit Normalization: KBW CEO

PositiveFinancial Markets

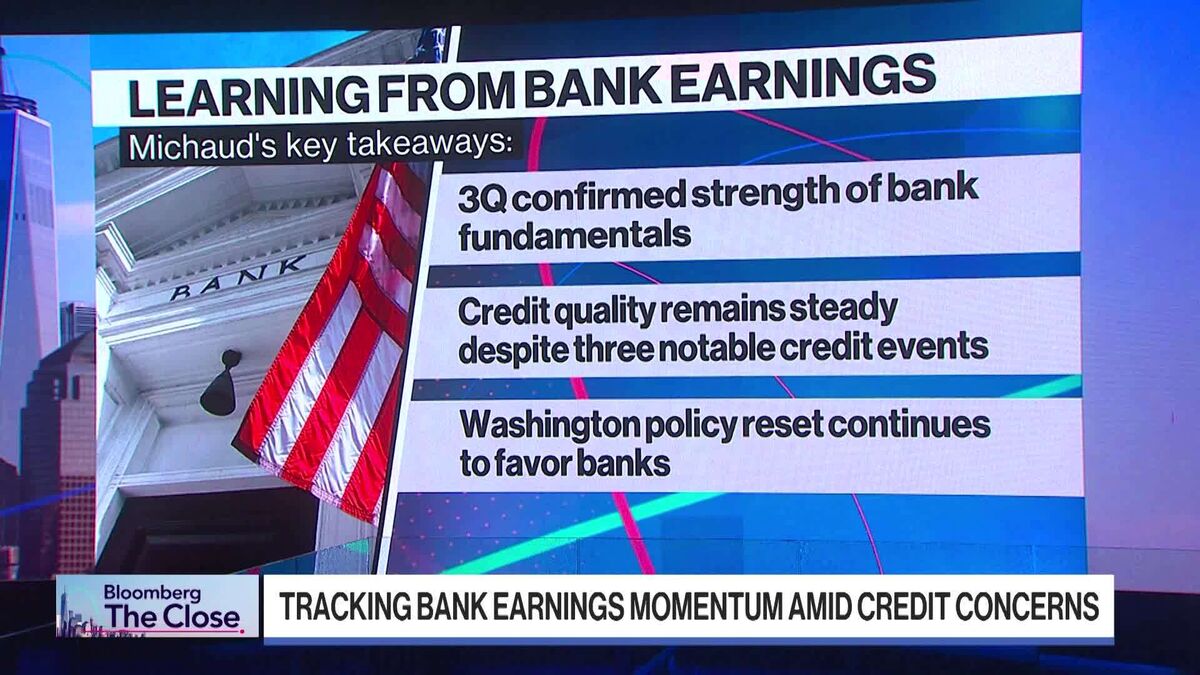

Thomas Michaud, the CEO of Keefe Bruyette & Woods, recently shared that the longest inverted yield curve in 47 years has finally ended, which is great news for banks. This shift means banks can expect better returns as conditions improve. It's a significant development that could lead to a more stable financial environment, benefiting both banks and their customers.

— Curated by the World Pulse Now AI Editorial System