Bank of America revamps Nvidia stock price after meeting with CFO

PositiveFinancial Markets

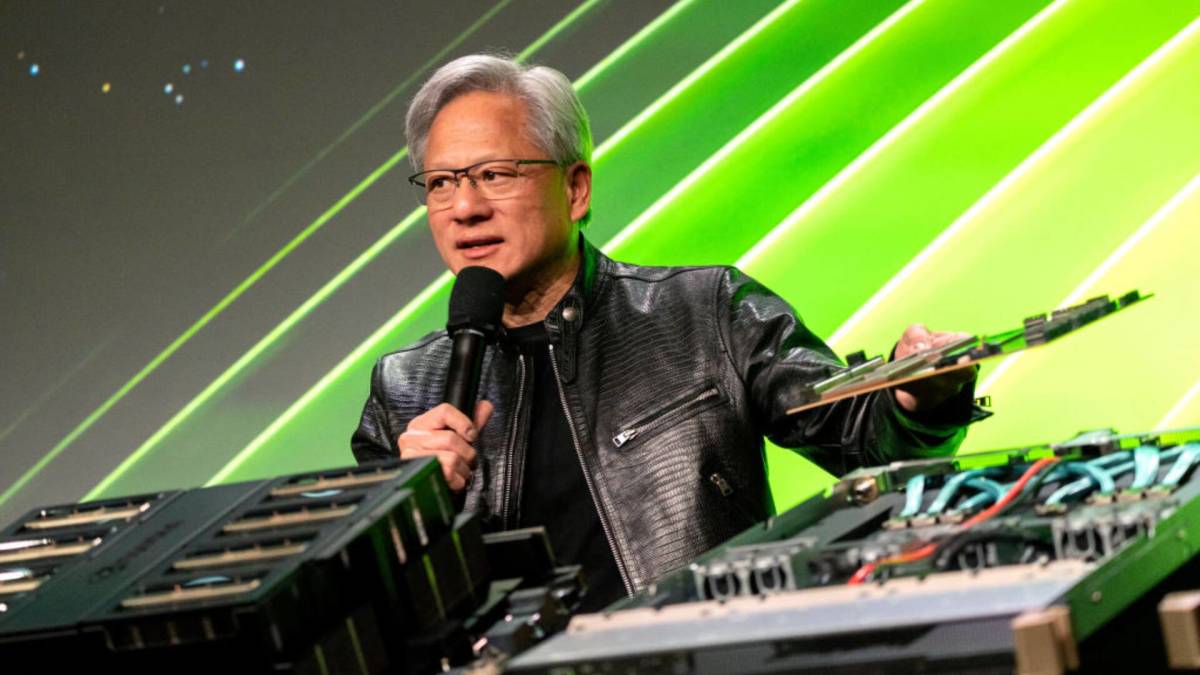

Nvidia has made headlines by becoming the first company to achieve a staggering $5 trillion market value, a significant milestone that reflects its transformation from a chip maker to a leader in the artificial intelligence sector. This achievement not only highlights Nvidia's innovative prowess but also signals a shift in the tech industry, emphasizing the growing importance of AI. Bank of America has responded to this development by adjusting its stock price outlook for Nvidia, indicating strong confidence in the company's future prospects.

— Curated by the World Pulse Now AI Editorial System