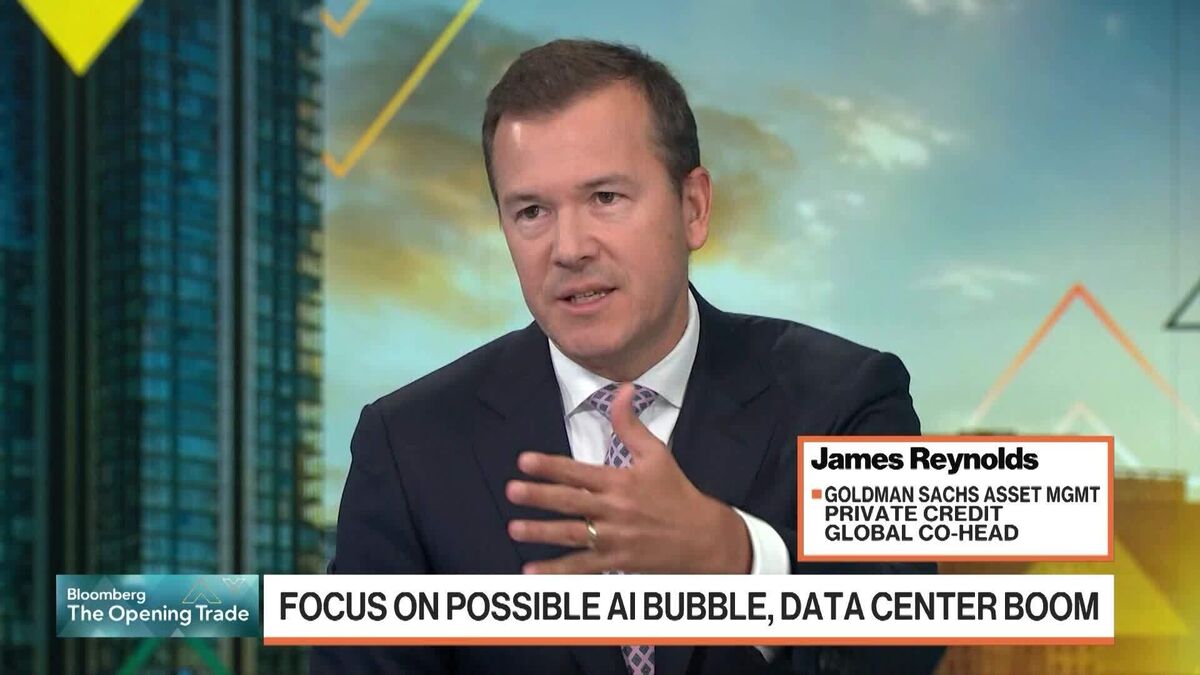

Goldman AM's Reynolds: Private Credit Results Will Vary

NeutralFinancial Markets

Goldman Sachs Asset Management's James Reynolds has highlighted that there will be significant variations in performance among private credit managers. This insight is crucial for investors as it underscores the importance of careful selection in a market where results can differ widely.

— Curated by the World Pulse Now AI Editorial System