New Crypto ETFs Launch in Crowded Field Despite SEC Shutdown

PositiveFinancial Markets

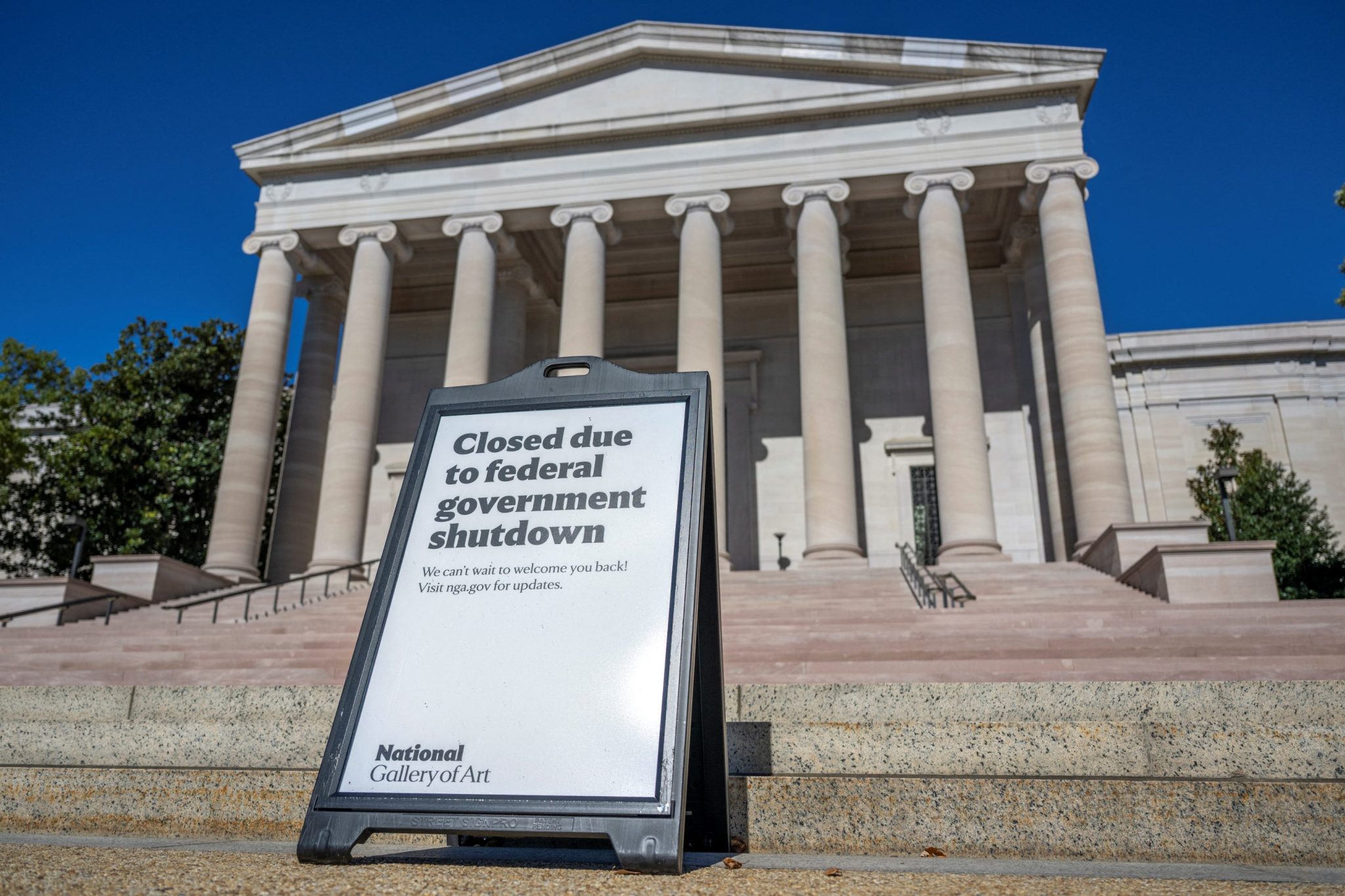

This week marks an exciting moment for the cryptocurrency market as several new exchange-traded funds (ETFs) focused on smaller cryptocurrencies are launching on Wall Street. Despite the ongoing government shutdown, issuers are moving forward with their listings, showcasing confidence in the crypto sector's resilience. This development is significant as it could attract more investors to the market, potentially boosting the overall cryptocurrency ecosystem.

— Curated by the World Pulse Now AI Editorial System