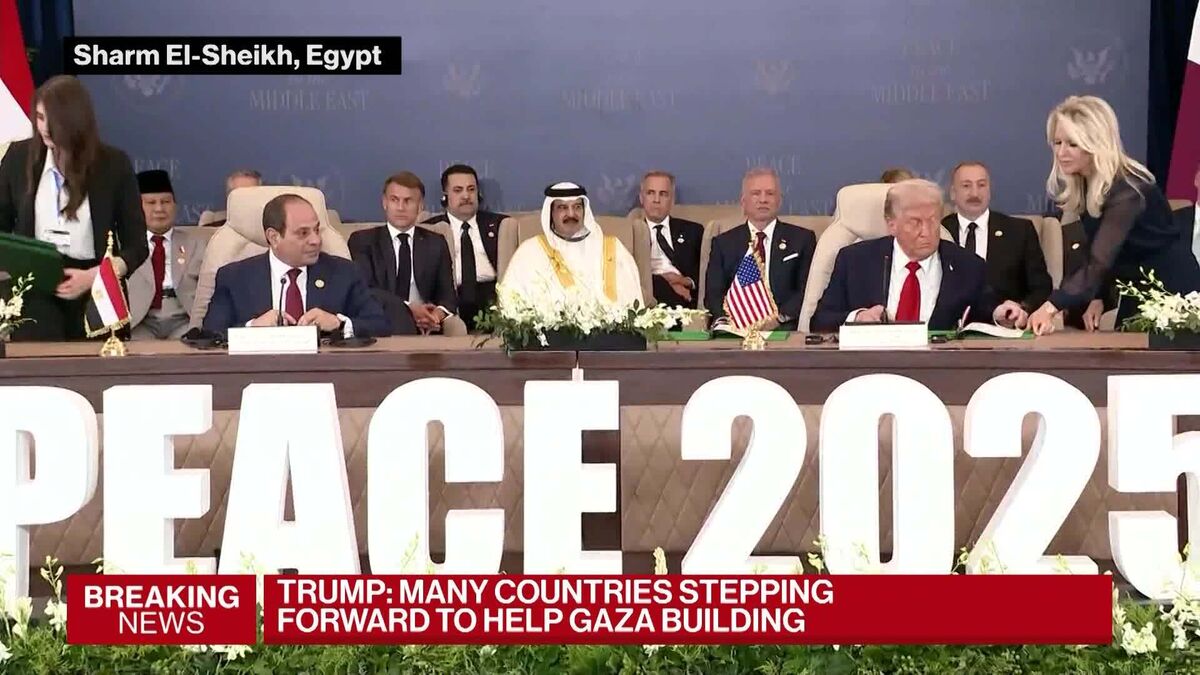

Hamas Is Weakened But Not Defeated — What This Means For Gaza’s Fragile Ceasefire

NeutralFinancial Markets

Hamas remains a significant force in Gaza despite being weakened, raising concerns about the stability of the fragile ceasefire. The group's reluctance to disarm suggests ongoing tensions in the region, which could lead to further violence. Understanding Hamas's influence and the threats posed by other non-state actors is crucial for assessing the future of peace in Gaza.

— Curated by the World Pulse Now AI Editorial System