JPMorgan Leading $5 Billion Loan Financing for Qualtrics Deal

PositiveFinancial Markets

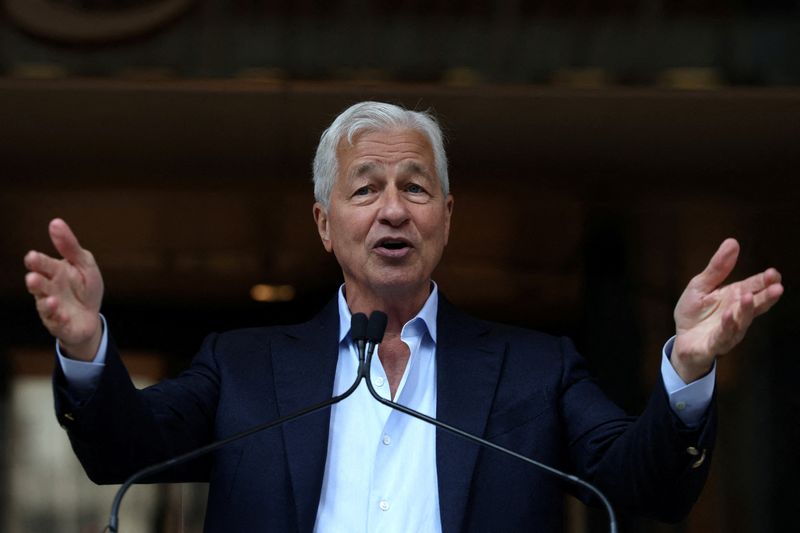

JPMorgan Chase & Co. is stepping up to lead a significant $5 billion loan financing for Qualtrics International Inc. as it acquires the health-care survey firm Press Ganey Forsta. This move not only highlights JPMorgan's strong position in the financial sector but also underscores the growing importance of data in healthcare, making it a pivotal moment for both companies involved.

— Curated by the World Pulse Now AI Editorial System