Mid-America Apartment Communities stock hits 52-week low at $131.46

NegativeFinancial Markets

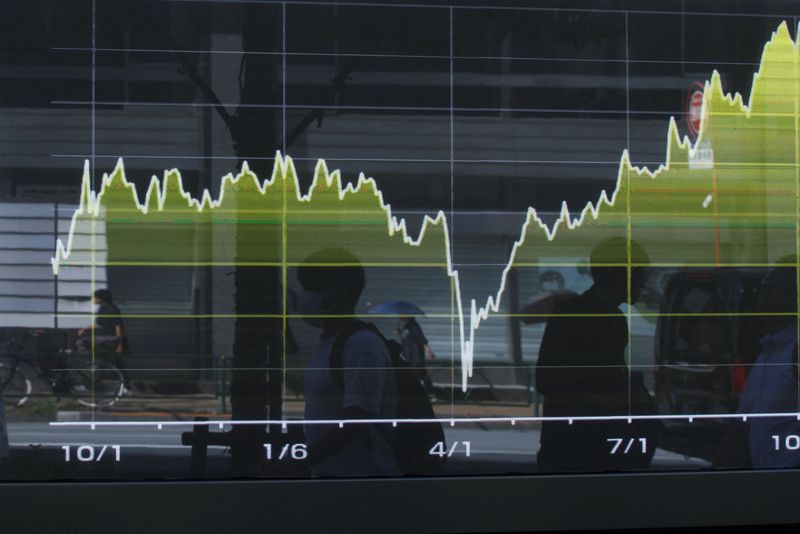

Mid-America Apartment Communities has seen its stock plummet to a 52-week low of $131.46, raising concerns among investors about the company's performance in the current market. This decline reflects broader trends in the real estate sector, where rising interest rates and economic uncertainties are impacting property values. Investors are closely monitoring this situation, as it could signal further challenges for the company and the industry as a whole.

— Curated by the World Pulse Now AI Editorial System