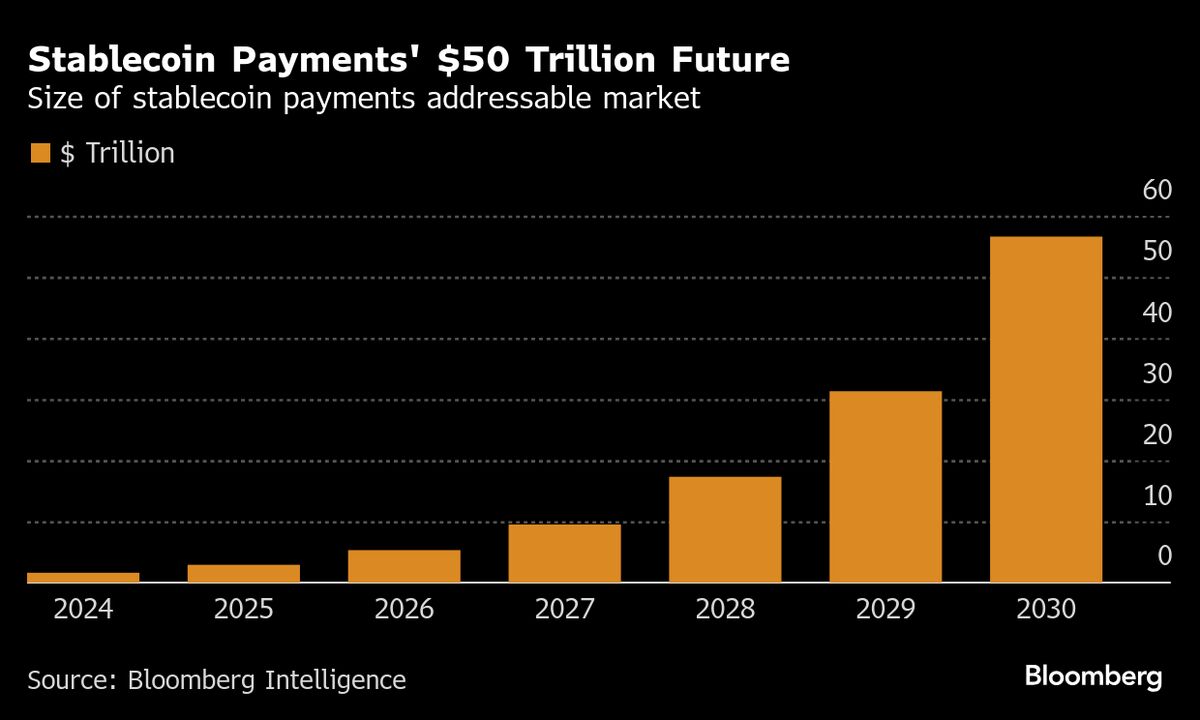

Citigroup to Join Banking Coalition Developing a Euro Stablecoin

PositiveFinancial Markets

Citigroup Inc. is making a significant move by joining a coalition of nine European banks to develop a regulated euro-based stablecoin. This initiative highlights the growing interest and investment in digital currencies by major financial institutions, signaling a shift towards more innovative and secure forms of money. As the digital economy expands, this development could pave the way for more stable and widely accepted digital transactions in Europe.

— Curated by the World Pulse Now AI Editorial System