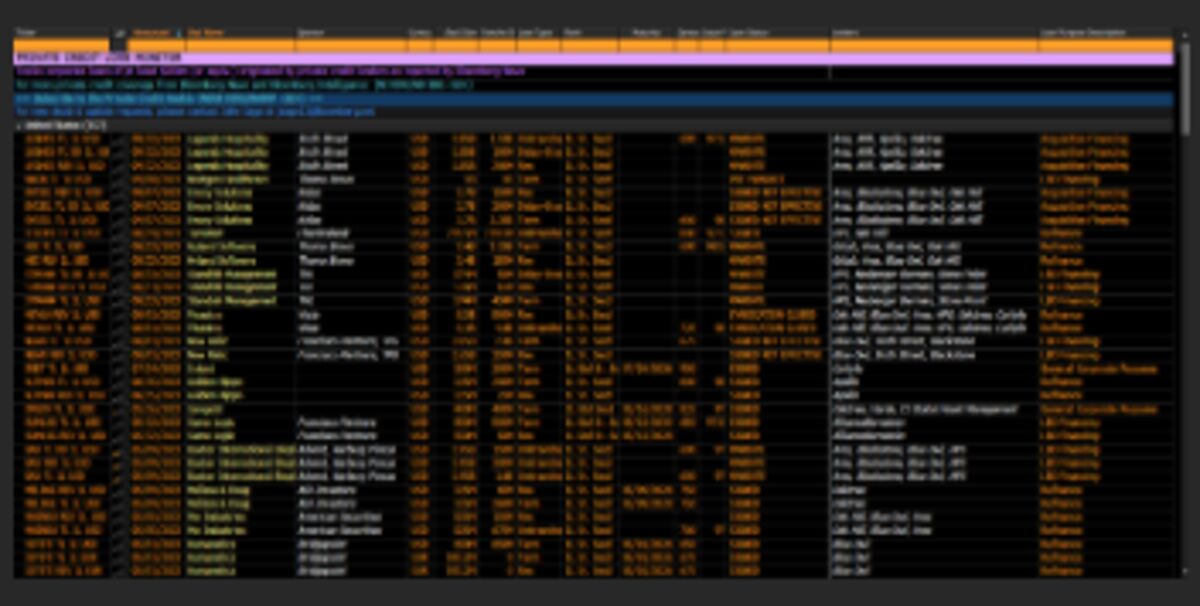

Private credit: what critics miss and what founders need to know

NeutralFinancial Markets

The article discusses the often-misguided critiques of private credit, emphasizing that many criticisms are based on sensational headlines rather than a deeper understanding of the structure, incentives, and outcomes involved. This matters because it highlights the need for founders to be informed about the realities of private credit, enabling them to make better financial decisions.

— Curated by the World Pulse Now AI Editorial System