Beach Point on Dispersion in Credit Markets

NeutralFinancial Markets

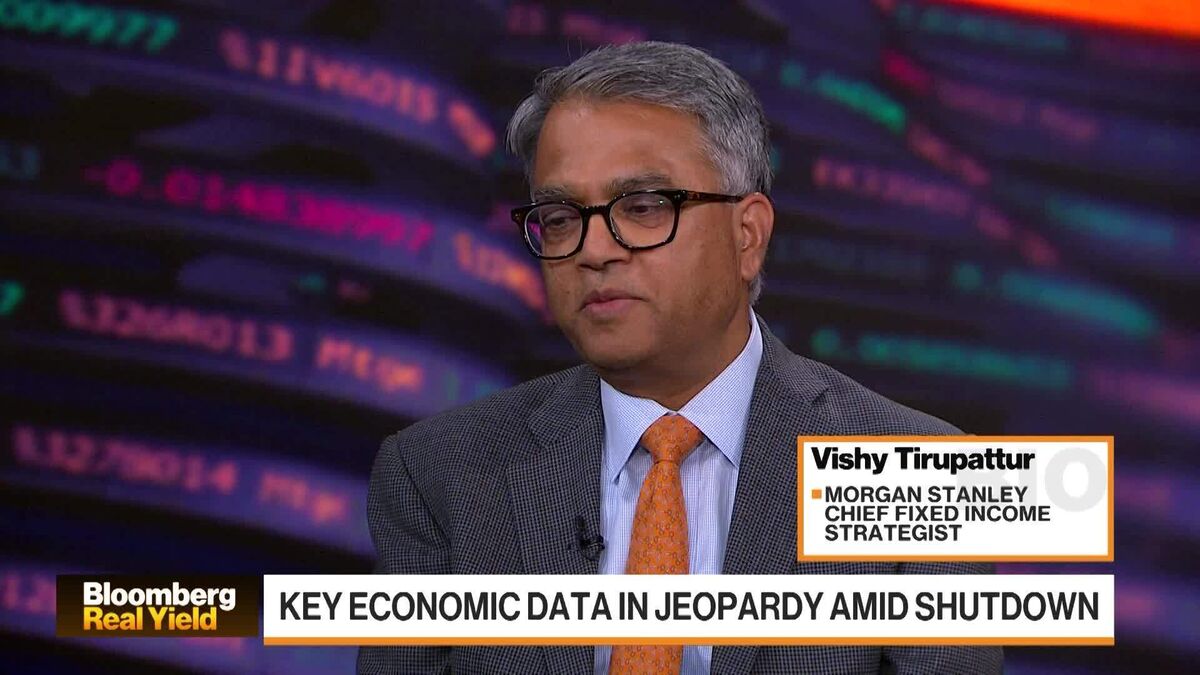

Sinjin Bowron, a portfolio manager at Beach Point, recently appeared on 'Bloomberg Open Interest' to discuss the current state of the credit market. His insights are valuable as they shed light on the factors influencing credit conditions, which can impact investors and the broader economy.

— Curated by the World Pulse Now AI Editorial System