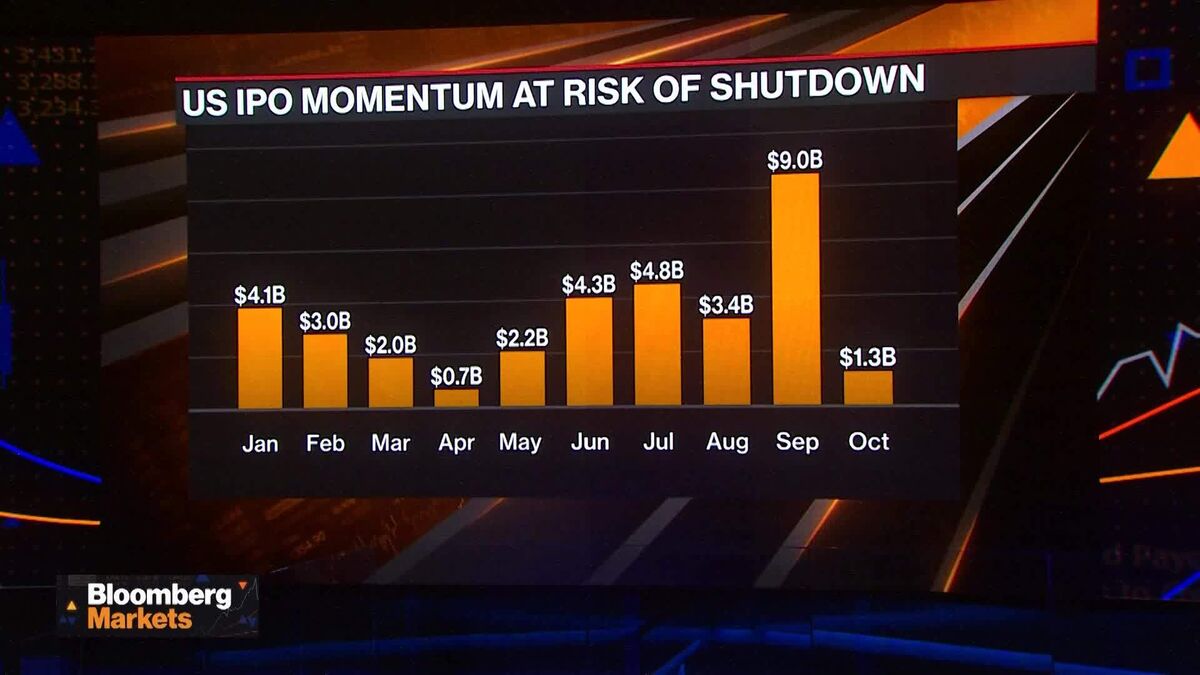

Shutdown Stalemate Brings US IPO Holdouts Off the Sidelines

PositiveFinancial Markets

Despite the ongoing government shutdown, companies in the US are moving ahead with innovative IPO plans, surprising many on Wall Street. This development is significant as it indicates resilience in the market and a willingness among businesses to adapt to challenging circumstances, potentially paving the way for a new wave of public offerings.

— Curated by the World Pulse Now AI Editorial System