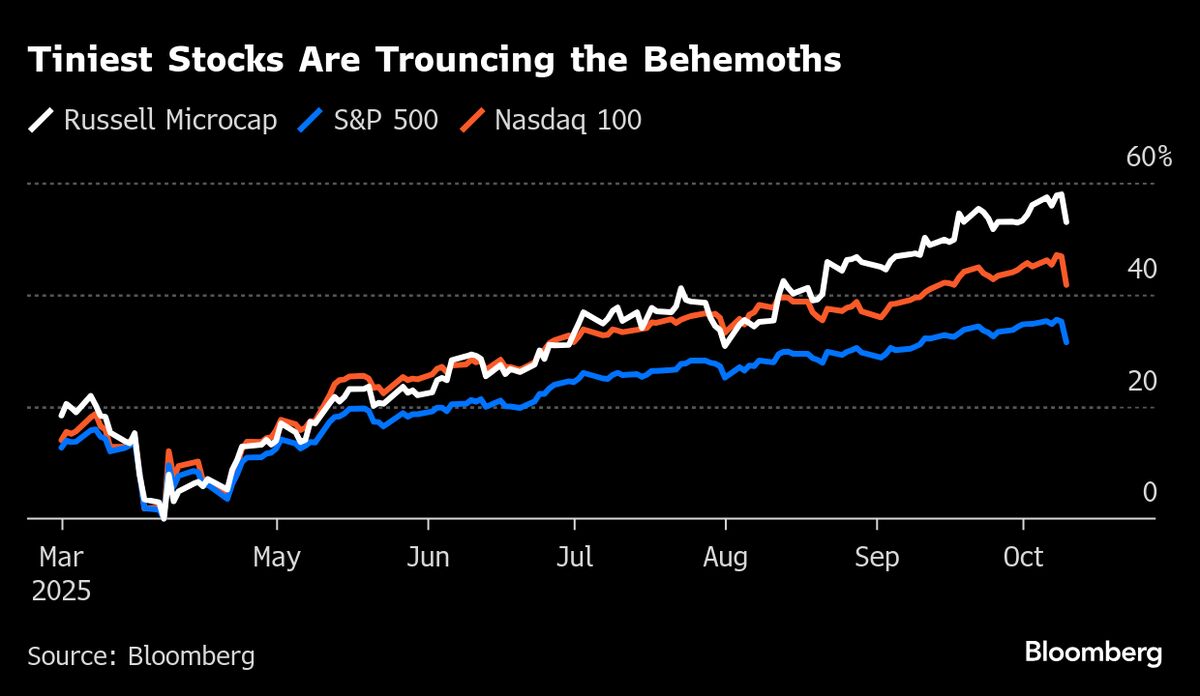

Bank of America says investors are ignoring one major stock market risk

NegativeFinancial Markets

Bank of America has raised concerns that investors might be overlooking a significant risk in the stock market, suggesting that the current calm could be deceptive. This matters because a sudden volatility shock could lead to unexpected losses for investors who are not prepared, highlighting the importance of vigilance in market conditions.

— Curated by the World Pulse Now AI Editorial System