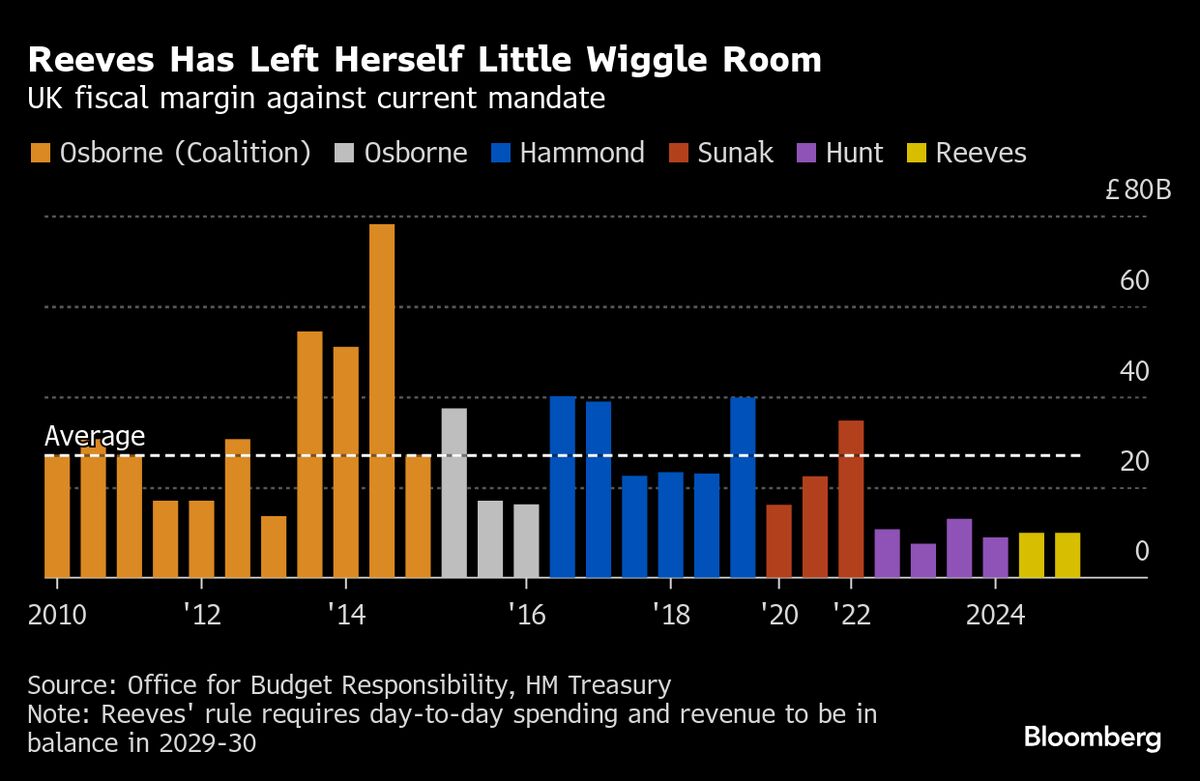

UK’s Reeves Hints at Bigger Fiscal Buffer as Budget Takes Shape

PositiveFinancial Markets

UK Chancellor Rachel Reeves is signaling a positive shift in fiscal policy as she prepares to enhance the country's financial buffer in the upcoming budget. This move aims to stabilize public finances and reflects a proactive approach to economic management. By outlining her plans in Washington, Reeves is not only addressing domestic concerns but also engaging with international audiences, which could bolster confidence in the UK's economic direction.

— Curated by the World Pulse Now AI Editorial System