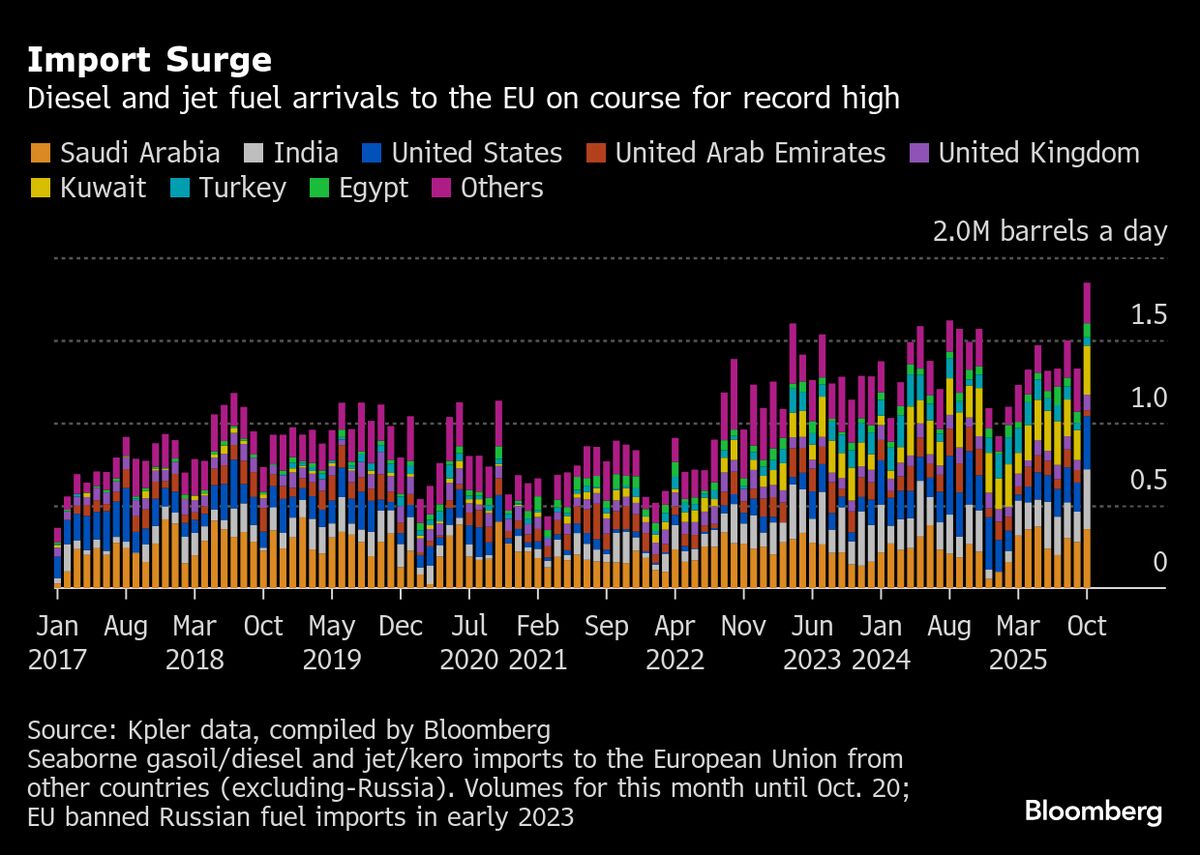

Europe Diesel and Jet Fuel Imports Jump as Traders Brace for Russia Sanctions

PositiveFinancial Markets

Europe is experiencing a surge in diesel and jet fuel imports, setting the stage for a record-breaking month. This increase comes as traders prepare for winter and anticipate stricter sanctions on petroleum products derived from Russian crude. This shift is significant as it highlights Europe's proactive approach to energy security and its efforts to reduce reliance on Russian oil, which could have long-term implications for the region's energy landscape.

— Curated by the World Pulse Now AI Editorial System