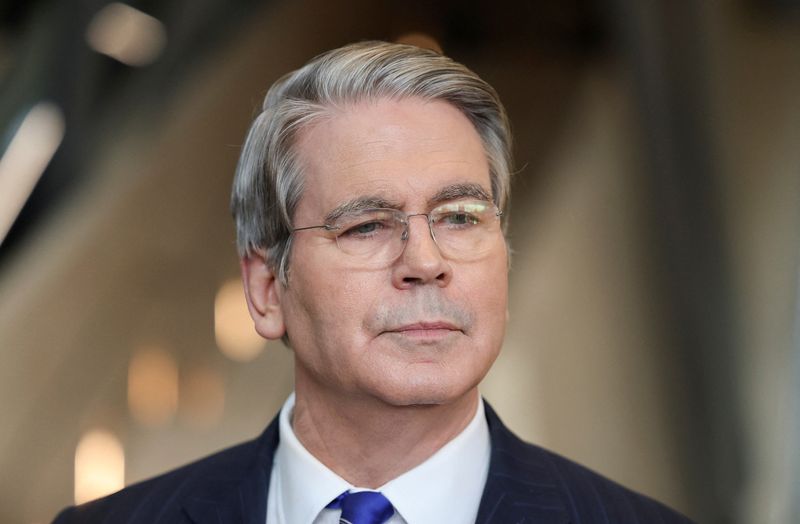

Caesars Entertainment Third-Quarter Loss Widens as Las Vegas Revenue Declines

NegativeFinancial Markets

Caesars Entertainment reported a wider loss in the third quarter, primarily due to declining revenue from its Las Vegas operations. This downturn is attributed to weak demand for leisure travel, which is concerning for the company and the broader tourism industry. As Las Vegas is a key market for Caesars, these results highlight the challenges faced by the casino sector in recovering from recent economic pressures.

— Curated by the World Pulse Now AI Editorial System