Top FX Forecaster Says Fed Remarks Key for Dollar Amid Shutdown

NegativeFinancial Markets

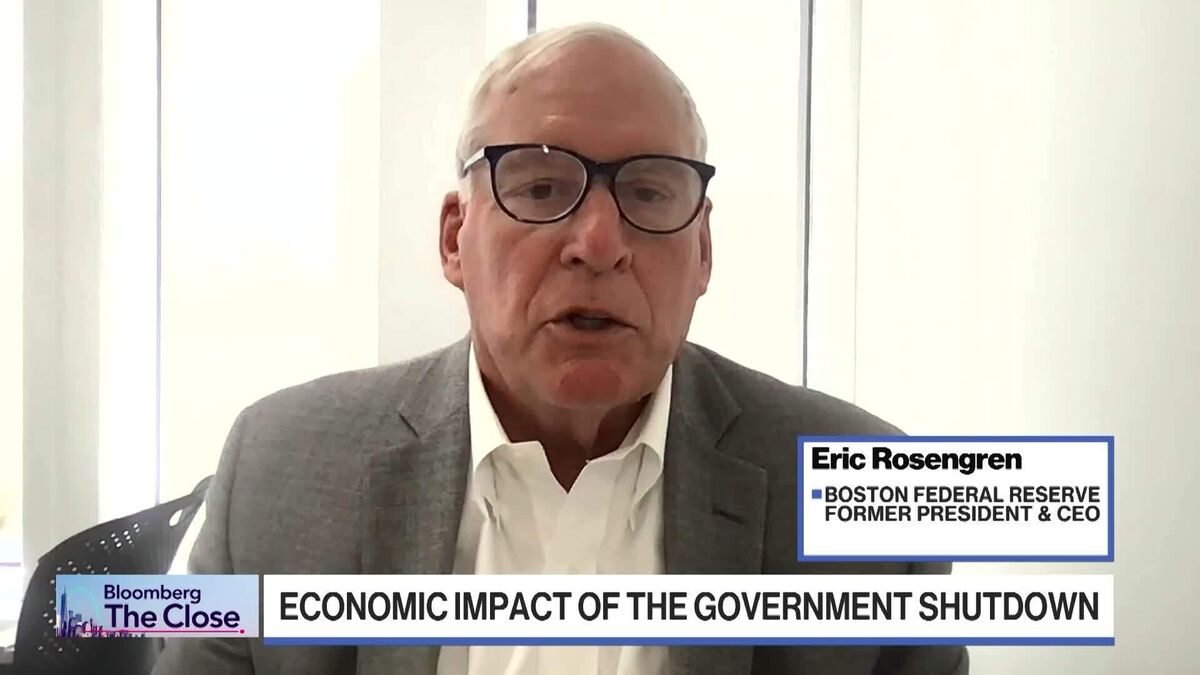

A leading foreign-exchange forecaster predicts that the dollar is set to weaken further as the US government shutdown continues into its second day. This situation is significant because it highlights the potential economic impacts of political gridlock, which can affect currency stability and investor confidence.

— Curated by the World Pulse Now AI Editorial System